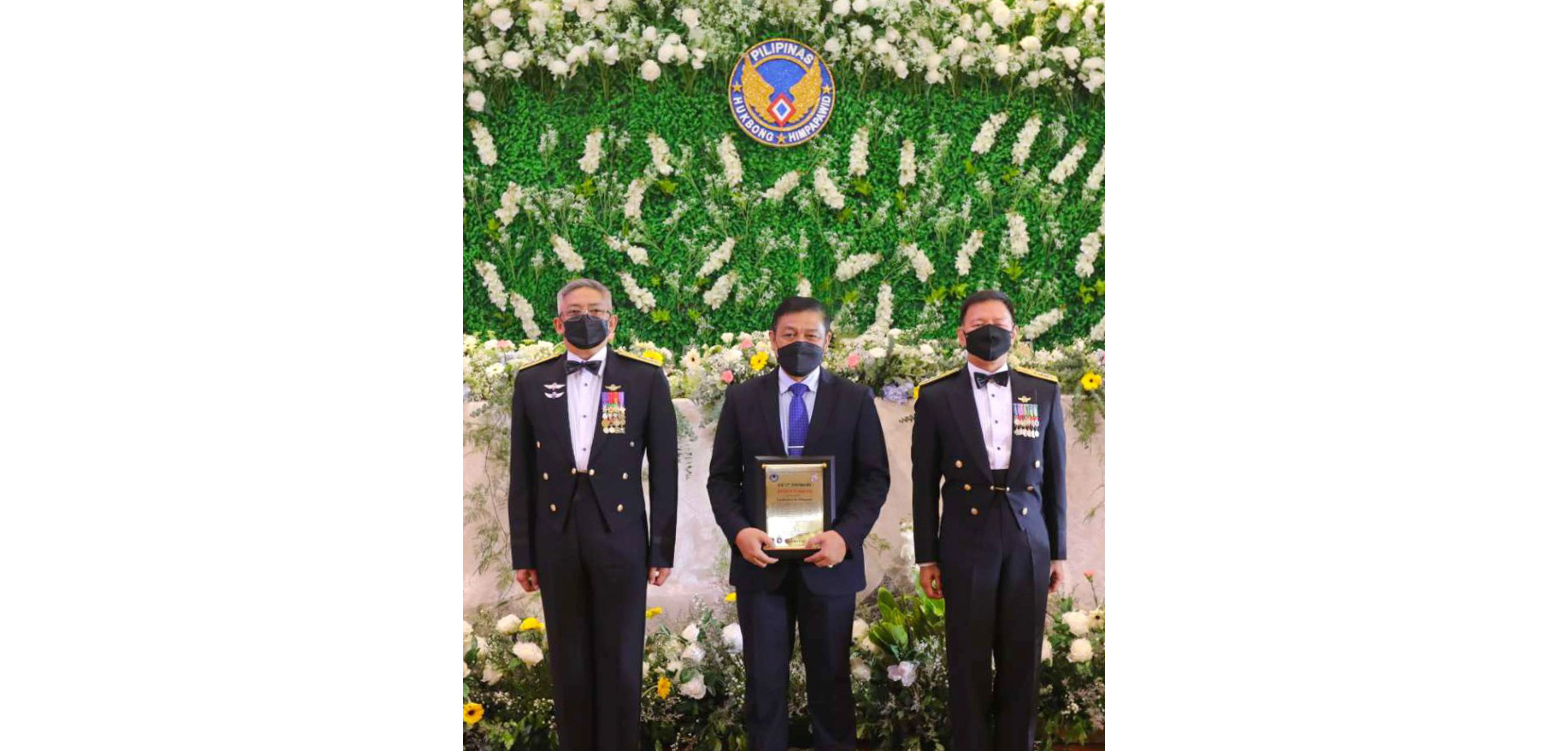

LANDBANK South NCR Branches Group Head, Senior Vice President Ramon R. Monteloyola (center) receives the plaque of recognition on behalf of LANBANK from PAF Commanding General Lt. Gen. Connor Anthony D. Canlas, Sr. (left) and AFP Vice Chief of Staff Lt. Gen. Erickson R. Gloria (right) during the PAF 75th Anniversary Night celebration.

The Land Bank of the Philippines (LANDBANK) was conferred with the Outstanding Stakeholder honor for the second year in a row by the Philippine Air Force (PAF) during its 75th Anniversary Night celebration at the Sheraton Hotel in Pasay City.

The PAF recognized LANDBANK’s invaluable and continuous support over the years, notably the Bank’s digital banking facilities that the Air Force is utilizing.

LANDBANK was instrumental in creating the one-time crediting system with the Air Force Accounting Office for PAF personnel’s salary and allowances; and the PAF Online Payment System which allows personnel to settle government-related accountabilities and dues through LANDBANK’s digital payment portal.

“LANDBANK is one with the Philippine Air Force in its ongoing defense modernization efforts, as we continue to serve the country’s armed forces with convenient and accessible digital banking services,” said LANDBANK President and CEO Cecilia C. Borromeo.

LANDBANK South NCR Branches Group Head, Senior Vice President Ramon R. Monteloyola received the plaque of recognition on behalf of the Bank from Armed Forces of the Philippines (AFP) Vice Chief of Staff Lt. Gen. Erickson R. Gloria and PAF Commanding General Lt. Gen. Connor Anthony D. Canlas, Sr.

To sufficiently serve PAF personnel especially during peak demand, LANDBANK recently installed an offsite ATM in Clark Air Base and deployed a mobile ATM at the Air Education Training and Doctrine Command at Fernando Air Base in Lipa City, Batangas.

The state-run Bank also previously facilitated the processing and distribution of LANDBANK ATM cards to all PAF trainees.

LANDBANK is leveraging on the latest technology to support the digitalization of various government operations as part of its expanded mandate of serving the nation.

LANDBANK aids recovery of quake-affected communities in Davao and Cebu

LANDBANK reaffirmed its commitment to disaster response and recovery by extending ₱3.2 million in financial assistance and ₱3.1 million worth of relief packs to earthquake-hit communities in Davao Oriental and Cebu on October 23, 2025. Finance Secretary and LANDBANK Chairman Ralph G. Recto, together with President and CEO Lynette V. Ortiz, led the simultaneous relief operations. “LANDBANK remains steadfast in providing timely assistance to our fellow Filipinos during times of crisis. Beyond immediate relief, we are equally focused on supporting the long-term recovery and rebuilding of affected communities,” said LANDBANK President and CEO Ortiz. In Davao Oriental, ₱500,000 was turned over to the provincial government, and ₱200,000 each to the City of Mati and Municipality of Manay. LANDBANK also distributed 1,000 grocery packs to displaced families, partly funded by voluntary donations from Bank employees. In Cebu, ₱2.3 million in financial aid was provided to 11 municipalities, including ₱500,000 each to Medellin, San Remigio, and Daanbantayan, and ₱100,000 each to Tabogon, Tabuelan, Sogod, Borbon, Catmon, Bantayan, Sta. Fe, and Madridejos. A total of 2,600 relief packs containing essential items, also funded in part by employee contributions, were also turned-over to the local Municipal Social Welfare and Development Offices of the said municipalities and Bogo City. Previously, LANDBANK extended ₱4.9 million in aid to Cebu Province, Bogo City, and Masbate, distributed 2,000 food relief packs, donated 32 portable water filtration systems, deployed mobile ATMs, and ensured branch operations resumed promptly. Beyond immediate relief, LANDBANK rolled-out financial programs to support long-term recovery, including the CARES Plus for MSMEs and cooperatives, Electronic Salary Loan (eSL), EasyCash for Emergencies, PeER Loan for pensioners and government employees, and Emergency Loans of up to ₱25,000. LANDBANK services remain accessible via 409 branches, over 2,900 ATMs nationwide, and online through the LANDBANK Mobile Banking App (MBA), iAcces, weAccess, and Link.BizPortal. For more information, visit any LANDBANK branch or call the Customer Care Hotline at (02) 8405-7000.

LEARN MORE

LANDBANK, DENR boost support for sustainable water and environmental initiatives

LANDBANK President and CEO Lynette V. Ortiz (2nd from right) and DENR Secretary Raphael P.M. Lotilla (2nd from left) formalize a partnership to strengthen the country’s water security and environmental resilience through the signing of a Memorandum of Understanding (MOU) on 15 October 2025 at the DENR Central Office in Quezon City. They are joined by LANDBANK Senior Vice President Gonzalo Benjamin A. Bongolan (rightmost) and DENR Undersecretary Carlos Primo C. David (leftmost). State-run LANDBANK and the Department of Environment and Natural Resources (DENR) have partnered to strengthen the country’s water security and environmental resilience through enhanced collaboration on water-related projects. The partnership was formalized through a signing of a Memorandum of Understanding (MOU) led by LANDBANK President and CEO Lynette V. Ortiz and DENR Secretary Raphael P.M. Lotilla on 15 October 2025 at the DENR Central Office in Quezon City. They were joined by LANDBANK Senior Vice President Gonzalo Benjamin A. Bongolan and DENR Undersecretary Carlos Primo C. David. Under the agreement, LANDBANK and the DENR will jointly promote sustainable water resource management by extending financial and technical support to water districts, local government units (LGUs), and other institutions engaged in water supply, sanitation, and conservation initiatives. “LANDBANK reiterates its commitment to provide accessible financing to water districts, LGUs, and other entities engaged in water supply, sanitation, and conservation projects. Together, we aim to build resilient communities, strengthen public health, and secure the country’s water future,” said LANDBANK President Ortiz, underscoring the urgency of sustainable water solutions in the face of climate-related challenges. The partnership builds on the Bank’s existing H2OPE Lending Program (Water Program for Everyone), through which LANDBANK has already released ₱5 billion in financing to 35 borrowers nationwide as of August 2025. This enhanced collaboration will further scale up support for water-related initiatives nationwide. LANDBANK will allocate funds and design financing programs for eligible projects, promote concessional lending opportunities, and provide related financial services. As a Direct Access Entity (DAE) to the Green Climate Fund (GCF), LANDBANK will also partner with the DENR to develop and manage projects for GCF funding. “Integrated water management is a challenge that we need to be constantly working on. With LANDBANK's support as the implementing agency for the loan facility, we can move forward with ease, without having to establish a new system and new agencies to administer the same. Through this partnership, we will also explore a responsive loan instrument for water service providers to better support their operations and improve access to safe water across communities,” said DENR Sec. Lotilla. For its part, the DENR will identify priority water programs and provide technical guidance in water resource management, conservation, and environmental impact assessments. It will likewise assist eligible proponents in securing necessary environmental permits and approvals. Eligible projects include the development and rehabilitation of water supply systems, wastewater treatment, watershed protection, and other climate-resilient water resource projects aligned with national policies and UN Sustainable Development Goal (SDG) 6 on clean water and sanitation for all.

LEARN MORE

Harvest of Dreams: Citrus pioneer turns Malabing Valley into land of opportunities

In Nueva Vizcaya, talk about citrus and one name always comes to mind. Known as the province’s Father of Citrus for pioneering the local citrus industry, farmer Alfonso Namuje, Jr. has long been recognized as a local hero, whose vision and determination turned Malabing Valley into a thriving citrus hub. “Nung bata pa ako, mahilig na ako magtanim ng mga halaman. Baka yun ang ibinigay ng Diyos sakin,” Mr. Namujhe recalls. From a young age, he was drawn to plants, a passion that led him to study agriculture in college. But life led him to a different direction. He found himself working at a pig farm in Laguna, where he eventually became a manager. It was only after seeing how the fruits he planted in his backyard were celebrated by the community that he realized his true calling. “Yung mga prutas na tinanim ko, pinag-piyestahan ng mga tao. Naisip ko na ito pala ang magpapayaman sa lugar,” he says. This inspired him to return to Malabing Valley and dedicate himself fully to uplifting his hometown through citrus farming. Before Mr. Namujhe introduced citrus, the valley’s main crops were corn and coffee. However, years of armed conflict had turned the area into a settlement for former rebel forces making financial institutions wary of investing. Still, he believed that providing livelihoods could be a powerful tool for change. “If there’s a marketable farm product in the area, the government will take notice. Roads, electricity, infrastructure — they will follow,” he says. Guided by this vision, he introduced citrus to the valley. He then left his well-paying job and moved back to Malabing Valley with his family. Together, they began building the foundation for what would become a thriving citrus hub. He established the Namujhe Integrated Farm, and shared knowledge with fellow farmers through the Malabing Valley Multi-Purpose Cooperative (MVMPC), which he helped organize. As interest in citrus grew, more farmers sought guidance. Through the MVMPC, farmers gained access to techniques, financial support, and farm inputs, while his own farm became a living classroom and an agri-tourism site. A critical part of this transformation was LANDBANK which believed in Mr. Namujhe’s vision when others refused to. The Bank provided the financial support needed for farmers to invest in inputs and expand operations. Citrus farming soon became a viable industry, improving livelihoods and attracting government attention — roads were built, connecting communities and markets, and what once took a five-day carabao ride to reach Solano could now be traversed in hours. Through years of research and experimentation, Mr. Namujhe refined orchard management, introduced new cultivars, and shared his knowledge with students, co-farmers, and visitors. Malabing Valley became the heart of citrus production in Cagayan Valley, with Kasibu officially recognized as the Citrus Capital of Luzon. “Nagpapasalamat talaga ang mga tao. They accept na ako talaga ang dahilan na nag-improve ang kanilang buhay. Sa akin, that’s my achievement. I can be proud of it,” he shared, reflecting on the gratitude of local farmers. “Si Dad, ibang level talaga. One man’s dream, naging isang community. Isang tao lang ang gumawa nito, and pulled everybody up,” says his daughter Josephine, who was inspired to follow his father’s footsteps. “Yung mga politician sinasabi nila, 'Alam mo, kami makakalimutan, pero ikaw – yung binigay mo na legacy dito, I don’t think makakalimutan ka,’” Josephine proudly added, highlighting how his father’s contributions have left a lasting imprint on the community. Mr. Namujhe’s efforts provided not just a new crop, but a new foundation for success, empowering countless farmers by granting them access to innovative citrus production techniques, financial support, and necessary farm supplies. Through his work, many young people were able to pursue their education, and several families successfully built quality homes and acquired properties in the lowlands. His leadership and advocacy significantly contributed to creating job opportunities, effectively improving the livelihood of the entire community. His pioneering work has earned him national recognition. Most recently, LANDBANK’s Gawad TANYAG Awards honored him as Ulirang Magsasaka, acknowledging the impact of his leadership, innovation, and community transformation. “LANDBANK is doing their work, kaya I'm loyal to them. Maraming pumupunta sa akin na iba. Pero hanggang nandiyan pa ang LANDBANK, kasama ko yan,” he added. Through his vision, determination, and unwavering commitment to his community, Mr. Namujhe turned a once-overlooked valley into a thriving citrus hub — leaving a legacy that will continue to inspire generations.

LEARN MORE