CATMON, Bulacan – In what was once a predominantly agricultural barangay of Santa Maria, Bulacan, a grassroots initiative that began with a handful of farmers under a sampaloc tree has blossomed into one of the province’s most progressive cooperatives.

Backed by the steadfast support of LANDBANK, Catmon Multi-Purpose Cooperative (MPC) has thrived by growing alongside its community—evolving to meet changing needs while staying true to its agricultural roots.

Growing up in Catmon, Emeliza Laurenciana, now the Chairperson of Catmon MPC, recalls the Cooperative as a constant in a community once surrounded by rice fields and backyard farms.

.png)

“It’s all thanks to the unwavering support of LANDBANK that our Cooperative has flourished, allowing us to uplift the lives of so many in our community, including mine,” Laurenciana shared.

From a Tree to a Vision

Catmon MPC’s journey started in 1987, when 26 farmers and livestock raisers came together with a shared mission—to improve their lives and uplift their community through agriculture. Each contributed ₱500, pooling a total initial capital of ₱12,500 that would mark the foundation of what is now a pillar of grassroots development in the area.

“Back then, local farmers struggled with limited access to capital, technical know-how, and reliable markets. We saw those gaps firsthand, and that became our driving force—to build a Cooperative that could offer real, lasting support where it was most needed,” shared Luisito dela Rosa, one of the 26 founding members who now serves as Catmon MPC’s General Manager.

The Cooperative initially focused on livestock production, and with a small grant from the Department of Agriculture (DA), it built a feed mill—a critical asset that improved access to affordable, high-quality animal feeds for farmers across Catmon.

A Timely Opportunity

A pivotal moment in Catmon MPC’s history was when a representative from LANDBANK visited the Cooperative in 1989 and offered financial access.

“We didn’t let that opportunity pass. Because of LANDBANK, we secured the capital we needed for rice production and other ventures,” said Dela Rosa.

What started as a single loan to fund agricultural production evolved into a long-term partnership. As the landscape of Catmon shifted from farmlands to residential areas, the Cooperative kept pace by expanding its services to remain a relevant support system for its members.

Through all these developments, LANDBANK remained a steadfast partner, providing not only financing but also guidance to help the co-op adapt and expand its reach.

“LANDBANK’s support has always allowed us to think ahead. They helped us adapt as our surroundings changed. We’ve expanded our services not just to sustain livelihoods, but to help our members and their families build better lives,” added Laurenciana.

New Products, New Purpose

.png)

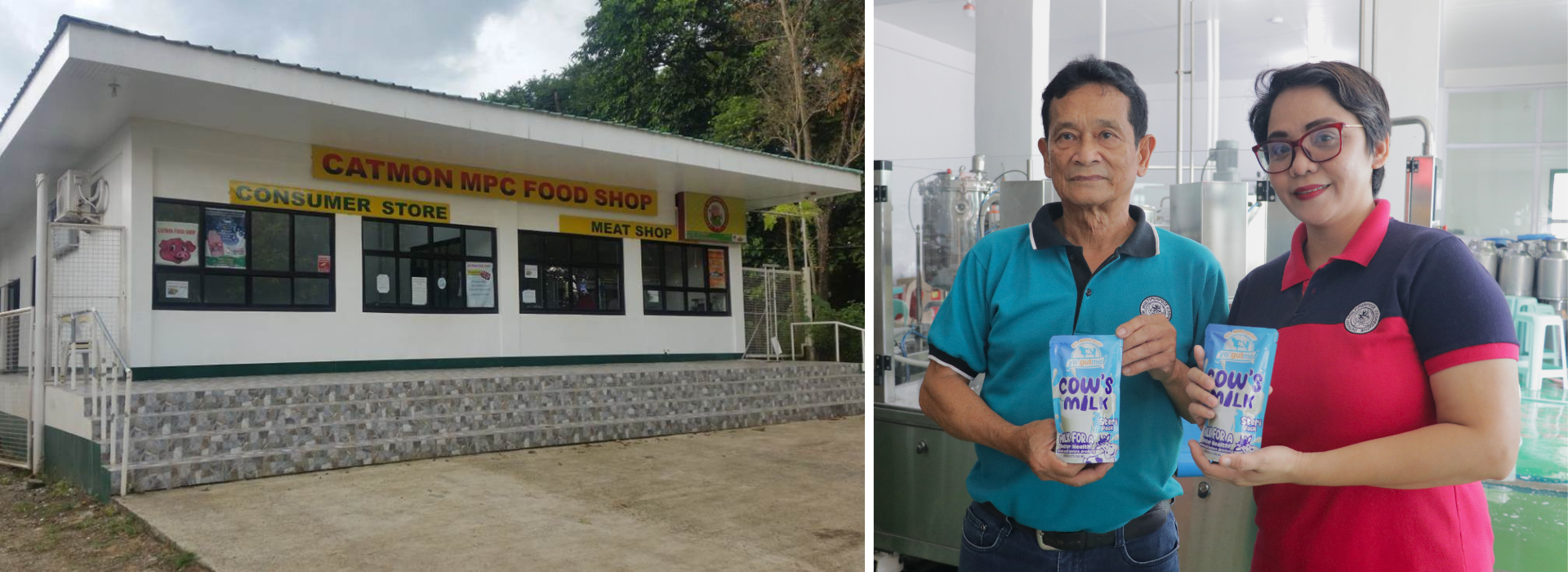

Today, Catmon MPC has expanded into dairy production, offering yogurt, flavored milk, and sterilized milk—products that are especially popular among the younger residents in Sta. Maria. The Cooperative also continues to provide financial and livelihood assistance to both long-time members and new households in the community.

“What began under a sampaloc tree has now grown into offices and facilities serving communities across Sta. Maria, Bulacan,” shared Dela Rosa, reflecting on the Cooperative’s journey.

“To grow with the community means evolving with it. We were founded on agriculture, and that will always be our foundation. But LANDBANK has helped us build on that, expanding our reach without losing sight of where we came from,” he added.

Empowering Through Capacity-Building

Like its partner LANDBANK, Catmon MPC emphasizes capacity-building as a core value. It regularly conducts training programs to equip members with tools to turn financial and livelihood assistance into sustainable, long-term development.

Today, more than three decades since its founding, with over 14,000 members and an asset base exceeding P900 million, Catmon MPC’s continued growth is rooted in a clear vision, strong leadership, and deep ties to its community.

Even amid rapid change, it embraces new opportunities, and the Cooperative remains grounded in its original mission: to serve and uplift the community of Catmon.

The enduring partnership between LANDBANK and Catmon MPC reflects a shared commitment to driving local development. From a modest effort by a small group of determined farmers that has become a multi-sector cooperative, their story stands as an inspiring example of what can be achieved through trust, adaptability, and a shared mission to empower communities and build a more inclusive, sustainable future.

ABOUT LANDBANK

LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

Harvest of Dreams: Citrus pioneer turns Malabing Valley into land of opportunities

In Nueva Vizcaya, talk about citrus and one name always comes to mind. Known as the province’s Father of Citrus for pioneering the local citrus industry, farmer Alfonso Namuje, Jr. has long been recognized as a local hero, whose vision and determination turned Malabing Valley into a thriving citrus hub. “Nung bata pa ako, mahilig na ako magtanim ng mga halaman. Baka yun ang ibinigay ng Diyos sakin,” Mr. Namujhe recalls. From a young age, he was drawn to plants, a passion that led him to study agriculture in college. But life led him to a different direction. He found himself working at a pig farm in Laguna, where he eventually became a manager. It was only after seeing how the fruits he planted in his backyard were celebrated by the community that he realized his true calling. “Yung mga prutas na tinanim ko, pinag-piyestahan ng mga tao. Naisip ko na ito pala ang magpapayaman sa lugar,” he says. This inspired him to return to Malabing Valley and dedicate himself fully to uplifting his hometown through citrus farming. Before Mr. Namujhe introduced citrus, the valley’s main crops were corn and coffee. However, years of armed conflict had turned the area into a settlement for former rebel forces making financial institutions wary of investing. Still, he believed that providing livelihoods could be a powerful tool for change. “If there’s a marketable farm product in the area, the government will take notice. Roads, electricity, infrastructure — they will follow,” he says. Guided by this vision, he introduced citrus to the valley. He then left his well-paying job and moved back to Malabing Valley with his family. Together, they began building the foundation for what would become a thriving citrus hub. He established the Namujhe Integrated Farm, and shared knowledge with fellow farmers through the Malabing Valley Multi-Purpose Cooperative (MVMPC), which he helped organize. As interest in citrus grew, more farmers sought guidance. Through the MVMPC, farmers gained access to techniques, financial support, and farm inputs, while his own farm became a living classroom and an agri-tourism site. A critical part of this transformation was LANDBANK which believed in Mr. Namujhe’s vision when others refused to. The Bank provided the financial support needed for farmers to invest in inputs and expand operations. Citrus farming soon became a viable industry, improving livelihoods and attracting government attention — roads were built, connecting communities and markets, and what once took a five-day carabao ride to reach Solano could now be traversed in hours. Through years of research and experimentation, Mr. Namujhe refined orchard management, introduced new cultivars, and shared his knowledge with students, co-farmers, and visitors. Malabing Valley became the heart of citrus production in Cagayan Valley, with Kasibu officially recognized as the Citrus Capital of Luzon. “Nagpapasalamat talaga ang mga tao. They accept na ako talaga ang dahilan na nag-improve ang kanilang buhay. Sa akin, that’s my achievement. I can be proud of it,” he shared, reflecting on the gratitude of local farmers. “Si Dad, ibang level talaga. One man’s dream, naging isang community. Isang tao lang ang gumawa nito, and pulled everybody up,” says his daughter Josephine, who was inspired to follow his father’s footsteps. “Yung mga politician sinasabi nila, 'Alam mo, kami makakalimutan, pero ikaw – yung binigay mo na legacy dito, I don’t think makakalimutan ka,’” Josephine proudly added, highlighting how his father’s contributions have left a lasting imprint on the community. Mr. Namujhe’s efforts provided not just a new crop, but a new foundation for success, empowering countless farmers by granting them access to innovative citrus production techniques, financial support, and necessary farm supplies. Through his work, many young people were able to pursue their education, and several families successfully built quality homes and acquired properties in the lowlands. His leadership and advocacy significantly contributed to creating job opportunities, effectively improving the livelihood of the entire community. His pioneering work has earned him national recognition. Most recently, LANDBANK’s Gawad TANYAG Awards honored him as Ulirang Magsasaka, acknowledging the impact of his leadership, innovation, and community transformation. “LANDBANK is doing their work, kaya I'm loyal to them. Maraming pumupunta sa akin na iba. Pero hanggang nandiyan pa ang LANDBANK, kasama ko yan,” he added. Through his vision, determination, and unwavering commitment to his community, Mr. Namujhe turned a once-overlooked valley into a thriving citrus hub — leaving a legacy that will continue to inspire generations.

LEARN MORE

Strengthening Palawan’s agri value chain: LANDBANK expands financing support for farmers, agri stakeholders

BROOKE’S POINT, Palawan – LANDBANK continues to strengthen its support for farmers and other players in the agricultural value chain with the regional rollout of the AGRISENSO Plus Lending Program in this province, bringing low-interest financing and capacity-building support closer to more agricultural communities nationwide. Over 1,400 farmers from the municipalities of Aborlan, Bataraza, Brooke’s Point, Narra, Quezon, Rizal, and Sofronio Española gathered for the event, reflecting the strong interest of Palawan’s agri communities for accessible and affordable credit assistance. LANDBANK President and CEO Lynette V. Ortiz and Bangko Sentral ng Pilipinas (BSP) Director Mynard Bryan R. Mojica led the launch on 10 October 2025 at Brooke’s Point Event Center. They were joined by Brooke’s Point Mayor Cesareo R. Benedito Jr., Narra Mayor Gerandy B. Danao, and national and local partners from the Department of Agriculture (DA), Department of Agrarian Reform (DAR), National Irrigation Administration (NIA), Bureau of Fisheries and Aquatic Resources (BFAR), Agricultural Credit Policy Council (ACPC), and Philippine Crop Insurance Corporation (PCIC). “With the continued rollout of the LANDBANK AGRISENSO Plus Lending Program nationwide, we are deepening our commitment to empower farmers and other agri stakeholders, including those in far-flung provinces like Palawan. We aim to provide them with the financing, tools, and partnerships needed to strengthen agricultural productivity and build resilient livelihoods,” said LANDBANK President and CEO Ortiz. Inclusive and holistic agri financing Developed in partnership with the DA, DAR, ACPC, NIA and other private sector partners, the AGRISENSO Plus Lending Program is LANDBANK’s enhanced value chain-based financing initiative to provide holistic support to agricultural players. The Program offers a fixed interest rate of 4.0% per annum for small farmers, fishers, and ARBs, with competitive rates for their associations and organizations, micro, small, and medium enterprises (MSMEs), large enterprises, anchor firms, and agriculture graduates. Borrowers benefit from simplified documentary requirements, free life and credit life insurance, and expanded access to technical and market support to help boost productivity and profitability. The AGRISENSO Plus Lending Program is complemented by the LANDBANK ASCEND (Agri-Fishery Support through Capability Enhancement for Nationwide Development) initiative, a capacity-building component that provides farmers and fishers with training on digital financial literacy, sustainable agriculture, and enterprise development. As of August 2025, LANDBANK has released ₱1.78 billion in loans under the AGRISENSO Plus Program, supporting over 12,000 borrowers nationwide. The Palawan rollout follows successful launches in Pampanga, Cagayan, Isabela, Batanes, Bukidnon, and Iloilo, with the next rollout scheduled in Negros Occidental later this month. Strengthening partnerships for growth The AGRISENSO Plus Lending Program also connects farmers and fishers to market opportunities through partnerships with anchor firms, such as Kita Agritech Corporation, Sarisuki Stores, Inc., TAO Foods Company, Inc., Yovel East Research and Development, Inc., and Unified Tillers Agriculture Cooperative (UTAC). Santeh Feeds Corporation recently joined the roster of the Program anchor firms following the signing of a memorandum of agreement with LANDBANK on 07 October 2025 at LANDBANK Plaza in Manila. The partnership will broaden the Program’s reach to aqua farmers nationwide who use Santeh Feeds’ products and services. It aims to boost productivity and strengthen the economic resilience of aqua farmers, while advancing sustainable aquaculture practices across the country. LANDBANK remains steadfast in its mission to advance countryside development and ensure food security by scaling up inclusive and sustainable financing for the agriculture sector — empowering rural communities and cultivating growth from countryside to countrywide. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

Advancing digital financial inclusion: LANDBANK and Palawan State University launch Cash-Lite Campus initiative

PUERTO PRINCESA, Palawan – LANDBANK and Palawan State University (PSU) have partnered to launch the Cash-Lite Campus initiative, advancing digital financial literacy and empowering students with secure, efficient banking solutions. Launched on 9 October 2025 at the PSU Performing Arts Center, the initiative aims to reduce cash dependency and streamline transactions for University’s students, faculty, and staff through mobile and e-banking services. “LANDBANK is here to help students build digital confidence in managing their finances — safely, smartly, and efficiently. Whether paying school fees, buying meals, or splitting costs with friends, our digital solutions make everyday transactions simpler and more secure,” said LANDBANK President and CEO Lynette V. Ortiz, who led the event, together with PSU President Dr. Ramon M. Docto and other officials. The Cash-Lite Campus initiative introduces the LANDBANK Mobile Banking App (MBA) and other e-payment channels, equipping students with essential digital financial skills. A key feature is the LANDBANK Piso Plus account, which can be opened via the LANDBANK MBA, with no initial deposit or maintaining balance. Pre-launch activities on 8 October engaged students in interactive missions to promote account opening and digital engagement. The launch also featured a financial literacy session and live demonstrations of cashless transactions using the LANDBANK MBA, highlighting the convenience and security of digital banking. The initiative is expected to result in over 12,000 new account openings and a significant boost in digital transactions at PSU, supporting LANDBANK’s mission to advance financial inclusion in the education sector. LANDBANK President and CEO Lynette V. Ortiz (2nd from left) and Senior Vice President Catherine Rowena B. Villanueva (rightmost), together with Waves for Water Philippines Operations Director Francelline Jimenez (leftmost), turn over 16 filtration systems, 16 handwashing stations, and 32 jerry cans to Palawan State University (PSU) President Ramon M. Docto (2nd from right) as part of the Bank’s Corporate Social Responsibility (CSR) program. The facilities will help address the lack of potable water and handwashing areas in the University for the benefit of students and teachers. Following PSU, LANDBANK plans to expand the Cash-Lite Campus initiative nationwide, fostering digital adoption and financial empowerment among the youth. Through partnerships like this, LANDBANK continues to champion financial inclusion and digital innovation, ensuring students and educators are equipped to thrive in an increasingly digital economy.

LEARN MORE