Be in the know of the latest news and updates about LANDBANK.

DOLE, LANDBANK hand out P1.2 billion to workers amid COVID-19 adversity

In partnership with the Department of Labor and Employment (DOLE), the Land Bank of the Philippines (LANDBANK) will distribute a total of P1.2 billion-worth of financial assistance to 250,000 workers under the COVID-19 Adjustment Measures Program (CAMP). The CAMP program supports workers affected by the adverse economic impacts brought about by the COVID-19 pandemic and forms part of the government’s Social Amelioration Program (SAP). Based on submissions received by DOLE from 2,773 private companies, LANDBANK will release a one-time financial aid of P5,000.00 each to an initial batch of 250,000 worker-beneficiaries—majority of which are based in the National Capital Region (NCR). Through the LANDBANK Remittance System (LBRS)/PESONet Facility, the financial assistance will be directly credited to workers’ existing LANDBANK account, other bank accounts, or through remittance partner Palawan Express for those without a deposit account. LANDBANK is waiving all fees and charges for the cash grant. “We understand how our workers, regardless of their employment status, are experiencing reduced incomes brought about by this health and economic adversity. Rest assured that together with DOLE, LANDBANK is committed to provide immediate financial access to our workers and their families during this critical time,” LANDBANK President and CEO Cecilia C. Borromeo said. Under the social amelioration interventions of Republic Act No. 11469 or the “Bayanihan to Heal as One Act,” LANDBANK serves as partner of government agencies in delivering social protection programs to households most affected by the COVID-19 pandemic. For more updates, please follow, like, and share the official LANDBANK social media accounts—for Facebook and Instagram: @landbankofficial, and for Twitter: @LBP_Official, and the LANDBANK website: www.landbank.com.

LEARN MORE

LANDBANK distributes cash assistance to qualified PUV drivers

The Land Bank of the Philippines (LANDBANK) started releasing Tuesday (April 7) cash aid totaling P33,408,000.00 or P8,000 each to 4,176 Transport Network Vehicle Service (TNVS) drivers in the National Capital Region to help them cope with the suspension of mass public transportation amid the enhanced community quarantine in Luzon. The financial assistance is part of the Memorandum of Agreement (MOA) signed last April 3, 2020 between LANDBANK, the Department of Social Welfare and Development (DSWD) and the Land Transportation Franchising and Regulatory Board (LTFRB) for the distribution of emergency subsidy to qualified drivers of TNVS, Public Utility Jeeps (PUJs), UV Express (UVs), Public Utility Bus (PUBs), Point-to-Point Bus (P2P), Taxi, School Transport, Tourist Transport, and Motorcycle (MC) Taxi. Beneficiaries of the Pantawid Pamilyang Pilipino Program (4Ps) are not covered by this cash assistance and have been excluded by DSWD to avoid duplication of benefits. The cash aid may be claimed via over-the-counter transactions from the nearest open LANDBANK branch. LANDBANK is waiving all fees and charges for the cash grant. “We are working closely with the DSWD and LTFRB for the efficient and effective distribution of emergency subsidy to our PUV drivers. Rest assured that LANDBANK will continuously support the national government in carrying out social protection programs to combat COVID-19,” said LANDBANK President Cecilia C. Borromeo. The cash grant is in line with the passage of Republic Act No. 11469 or the “Bayanihan to Heal as One” Act and the issuance of DSWD-DOLE-DTI-DA-DOF-DBM Joint Memorandum Circular No. 1, Series of 2020 or the “Special Guidelines on the Provision of Social Amelioration Measures.” For more updates, please follow, like, and share the official LANDBANK social media accounts—for Facebook and Instagram: @landbankofficial, and for Twitter: @LBP_Official, and the LANDBANK website: www.landbank.com.

LEARN MORE

LANDBANK releases P16.3B to 3.7M Social Amelioration Program beneficiaries

To support families and communities severely affected by the COVID-19 pandemic, the Land Bank of the Philippines (LANDBANK) has started releasing cash grants totaling P16,347,295,950.00 to P3,721,826 Conditional Cash Tansfer (CCT) household-beneficiaries nationwide through the national government's Social Amelioration Program (SAP) intended for the purchase of basic food, medicine, and toiletries. Of the P16.34 billion total amount, P6.05 billion has already been credited to their LANDBANK Cash Cards Friday (April 3, 2020) for 1.19 million beneficiaries covering NCR, CAR, Regions I, II, III, IV-A, and ARMM. Meanwhile, LANDBANK will credit P5.26 billion-worth of cash grants on Saturday (April 4, 2020) for 1.29 million beneficiaries in Regions IV-B, V, VI, VII and IX, while the remaining balance of P5.01 billion cash grants will be released on Sunday (April 5, 2020) to 1.23 million beneficiaries in Regions VIII, X, XI, XII, CARAGA and all other regions. “We want to ensure that social protection programs reach our most vulnerable sectors during this crisis the soonest time possible. Through our LANDBANK Cash Cards, we are delivering financial assistance in an immediate, safe, secure, and convenient manner,” said LANDBANK President and CEO Cecilia C. Borromeo. LANDBANK’s release of the cash grants is in support of Joint Memorandum Circular No. 1, Series of 2020, which specifies the guidelines for the provision of social amelioration measures by the Department of Social Welfare and Development (DSWD), Department of Labor and Employment (DOLE), Department of Trade and Industry (DTI), Department of Agriculture (DA), Department of Finance (DOF), Department of Budget and Management (DBM), and Department of the Interior and Local Government (DILG) to the most affected residents of the current national health and economic emergency. The provision of SAP forms part of Republic Act No. 11469 or the “Bayanihan to Heal as One” Act, which greenlights urgent measures to combat COVID-19. The beneficiaries may withdraw from the 2,196 LANDBANK ATMs available nationwide, and the more than 20,000 ATMs of Bancnet-member banks free of charge. They may also use their LANDBANK Cash Cards to purchase goods from groceries and drugstores or withdraw money from LANDBANK's partner Cash-out Agents. For more updates, please follow, like, and share the official LANDBANK social media accounts—for Facebook and Instagram: @landbankofficial, and for Twitter: @LBP_Official, and the LANDBANK website: www.landbank.com.

LEARN MORE

LANDBANK backs LGUs with P10-billion emergency loan vs COVID-19

The Land Bank of the Philippines (LANDBANK) is launching a new lending program to help Local Government Units (LGUs) on the purchase of goods and procurement of services to support their constituents during the COVID-19 crisis. The Bank is allocating P10 billion for the LANDBANK HEAL (Help via Emergency Loan Assistance for LGUs) Program as emergency funding for provincial, city, and municipal governments. “The HEAL Program is LANDBANK’s way of supporting our LGUs deliver immediate health services, food, and basic commodities to their constituents during this crisis. Our LGUs are at the forefront of this adversity, and as our partners in development, we will continue to finance their recovery and rehabilitation needs,” LANDBANK President and CEO Cecilia C. Borromeo said. Both client and non-client LGUs of the Bank may avail of the HEAL Program at an affordable fixed interest rate of 5% per annum, payable up to a maximum of five years, with a one-year grace period on principal payment. The LANDBANK HEAL Program is also in support of Republic Act No. 11469, otherwise known as the “Bayanihan to Heal as One Act,” declaring a state of national health emergency, and grants President Rodrigo R. Duterte the power and authority to carry out urgent measures to combat COVID-19. This includes the provision of timely and affordable credit to affected sectors, especially in the countryside. Interested LGUs may contact the nearest open LANDBANK Lending Center or Branch nationwide, or call LANDBANK’s customer service hotline at (02) 8-405-7000 or at PLDT Domestic Toll Free 1-800-10-405-7000. For more updates and client advisories, please make sure to follow, like, and share the official LANDBANK social media accounts—for Facebook and Instagram: @landbankofficial, and for Twitter: @LBP_Official, and the LANDBANK website: www.landbank.com. Click here for more information.

LEARN MORE

LANDBANK assures CCT beneficiaries of their cash grants

The Land Bank of the Philippines (LANDBANK) today assured beneficiaries of the national government’s social intervention program—the Conditional Cash Transfer (CCT), under the Department of Social Welfare and Development’s (DSWD) Pantawid Pamilyang Pilipino Program (4Ps)—that the state bank will continue to release their cash grants as scheduled through their LANDBANK Cash Cards. Crediting of the cash grants to a total of 2,528,122 CCT beneficiaries nationwide will be on March 24, 26 and 28, 2020. At the same time, LANDBANK reminded the beneficiaries, including the general public, that LANDBANK Cash Cards may be used for cashless purchases of groceries and medicines in supermarkets and drugstores through the Point-of-Sale (POS) machines at the cashier or check-out counters. Also, in line with safety and health measures being adopted by the Bank, clients are encouraged to use LANDBANK’s ATMs and electronic banking channels which may be accessed 24/7, anytime, anywhere, instead of going to its branches. These include the LANDBANK Mobile App, iAccess, WeAccess, Link.Biz Portal, Electronic Tax Payment System and Phone Access. Meanwhile, LANDBANK also assured the public of its continued banking operations. Selected LANDBANK Branches in the NCR, Luzon, Visayas and Mindanao will remain open. For a list of these available branches, including updates and client advisories, please visit, like and share the official LANDBANK social media accounts—for Facebook and Instagram: @landbankofficial, and for Twitter: @LBP_Official, and the LANDBANK website: www.landbank.com.

LEARN MORE

LANDBANK pushes for use of digital, e-banking channels; continues service delivery

The Land Bank of the Philippines (LANDBANK) is urging its valued clients to utilize the Bank’s electronic and digital platforms to serve banking needs while the country is under a state of calamity due to the coronavirus disease (COVID-19) pandemic. “During these challenging times, the health of our customers has become our number one priority. We urge everyone to use LANDBANK’s digital and online banking services in the safety of their homes as much as possible, instead of physically visiting our Branches,” LANDBANK President and CEO Cecilia C. Borromeo said. President Borromeo strongly encourages the use of the LANDBANK Visa Debit Card and LANDBANK Mastercard Credit Card to make cashless payments at merchants accepting Visa and Mastercard. Likewise, the general public is urged to utilize LANDBANK’s 2,196 ATMs and 159 Cash Deposit Machines nationwide as of March 15, including online and electronic channels to access secure and convenient banking services. These channels include the LANDBANK Mobile Banking App, iAccess, WeAccess, Electronic Tax Payment System and Phone Access, which offer a wide array of services such as viewing of account balance, viewing of transaction history, and transferring of funds, among others. LANDBANK is also one of the first banks in the country to adopt the national QR standard in its Mobile Banking App, which facilitates faster and seamless person-to-person (P2P) fund transfers with greater ease and convenience. Through LANDBANK’s Link.BizPortal, clients can also pay for products and services via the internet from 700-enrolled private merchants and government institutions. This includes the payment of income tax returns (ITR) which are to be properly filed to the Bureau of Internal Revenue (BIR) by April 15, 2020. Continued Branch Operations Several LANDBANK Branches in the NCR and Luzon, as well as in Visayas and Mindanao, will remain open and continue banking operations from 9:00 AM to 2:00 PM starting March 18, 2020. While complying with the Enhanced Community Quarantine and the Stringent Social Distancing Measures over the entire Luzon, LANDBANK employees in the Head Office and selected branches are reporting for work as skeletal force to ensure that there will be no disruption in the delivery of the Bank’s services. Moreover, LANDBANK has started implementing safety health measures in its branches and offices nationwide, in line with upholding public health while continuing to serve banking needs. This forms part of LANDBANK’s Business Continuity Management (BCM) protocols, which have been activated to help prevent the spread of COVID-19 while maintaining normal banking operations. “LANDBANK is implementing these measures to ensure the health and safety of our customers and employees, which are of utmost importance at this time. Rest assured that as we exert efforts to protect public health, we will continue to provide reliable and accessible banking services,” President Borromeo added. Safety Health Measures LANDBANK Branches are now carrying out screening procedures for clients, which include temperature checks and provision of hand disinfectants prior to entry. Those with temperature readings of 38°C and above will not be allowed to enter the Bank. Social distancing is also promoted by limiting the number of customers on seating capacity inside the branch premises at any given time. For more updates and client advisories, including the availability of LANDBANK Branches nationwide, please make sure to follow, like, and share the official LANDBANK social media accounts—for Facebook and Instagram: @landbankofficial, and for Twitter: @LBP_Official, and the LANDBANK website: www.landbank.com.

LEARN MORE

Sugarcane coop reaps sweet success with DAR and LANDBANK’s support

Mirasol Development Corporation Agrarian Reform Cooperative (MDCARC) was established in 2014 through the assistance of the Department of Agrarian Reform (DAR) and Land Bank of the Philippines (LANDBANK), under the Agrarian Production Credit Program (APCP). SAGAY CITY, Negros Occidental – Farmer-members of the Mirasol Development Corporation Agrarian Reform Cooperative (MDCARC) were once on the brink of losing the land that they were tilling until they sought assistance from Land Bank of the Philippines (LANDBANK). Through the help of the Department of Agrarian Reform (DAR), MDCARC availed of the Agrarian Production Credit Program (APCP) with LANDBANK which allowed them to continue with the production of their sugarcane farms. “Malaki ang pasasalamat namin sa LANDBANK at sa DAR kasi kung wala sila, baka wala na yung lupa namin. Baka napunta na sa malalaking haciendero,” said MDCARC Chairman Arnold Lapuhapo. Established in 2014, MDCARC had an initial member of 134 small farmers who pursued their claim for agrarian reform coverage for the almost 40 hectares of agricultural land from its former owner-corporation. The DAR first assisted MDCARC in 2012 to capacitate them and prepare them for their land ownership, as well as the requirements of APCP availment, which eventually paved the way for LANDBANK to approve their P4.0M-credit line under the APCP in 2014 to finance their sugarcane cultivation and production. Aside from farming support, Lapuhapo said that APCP was also key in uplifting the lives of their farmer-members saying, “Maraming nagbago talaga. Dati nung meron pa kaming amo hindi namin naranasan magkaroon ng benepisyo at yung Pasko namin mahirap na mahirap. Ngayon, yung mga benepisyo namin at Pasko ay nakakaluwag na.” At present, MDCARC now owns almost 110 hectares of land dedicated to sugarcane farming. They are also building on the gains that they achieved from being an APCP availer by diversifying the coop’s business to microfinancing, poultry farming, and sand and gravel production, all for the benefit of their farmer-members. “Ipinagpatuloy namin yung pagpapalago sa coop namin para sa mga susunod na taon ay pataas nang pataas na lang ang aming assets at income,” Lapuhapo added. The APCP is a joint venture of DAR and LANDBANK, which aims to achieve sustainable crop production and increase the income of agrarian reform beneficiaries (ARBs) and their households through the provision of credit and capacity building assistance. Aside from APCP, LANDBANK also promotes other programs for the benefit of the ARBs. As the financial conduit of the Comprehensive Agrarian Reform Program (CARP), the Bank is involved in determining the land valuation and compensation for all lands covered under CARP, and the issuance of Certificate of Full Payment and Release of Real Estate Mortgage to ARBs. Last year, LANDBANK also partnered with DAR to introduce the Accessible Funds for Delivery to Agrarian Reform Benefeciaries (AFFORD-ARBs) Program which provided loans to finance the production of rice, corn, high-value crops, as well as farm implements. Outstanding loans for this Program in 2019 reached P100.86 million, which was availed by 523 farmer-borrowers and a cooperative. Meanwhile, the Bank and the Department of Agriculture (DA) is jointly implementing the Socialized Credit Program under the Sugarcane Industry Development Act (SCP-SIDA) for individual sugarcane farmers, block farms, and common service centers. In 2019, SCP-SIDA loans amounted to P111.37 million, assisting 992 farmers. For more information, log-on to LANDBANK’s official website at https://www.landbank.com/agrarian-operations or call the Bank’s Agrarian Services Group at (02) 8-405-7363, or visit the nearest LANDBANK Lending Center located nationwide.

LEARN MORE

Local agri-trader supports livelihood of 500 cassava farmers

CAGAYAN DE ORO, Misamis Oriental – In the uplands of this town, Ruben Gicabao and wife Lilibeth run an agri-business trading company which helps support the livelihood of some 500 small farmers in their community and neighboring areas who plant cassava, a nutrient-dense root vegetable used as raw material in food processing. Leaving his job in Manila after his father passed away in 2004, Ruben decided to revisit his father’s hometown in Cagayan de Oro City where he would eventually expand his father’s cassava trading business, the Agri de Oro VMB Marketing. The company started its operations by purchasing cassava from small farmers within their 50-meter radius in the neighboring towns of the Provinces of Bukidnon and Misamis Oriental. “We process the cassava from the farmers to produce granules which are sold to feed mills and traders. But as the demand for cassava chips rose over the years, my wife and I realized that we needed more capital to purchase enough cassava from more farmers, at the right and justifiable price,” Ruben said. In 2008, the couple applied for, and was granted a short-term loan (STL) assistance from Land Bank of the Philippines (LANDBANK), which enabled them to work with about 500 small farmers who plant cassava, even just in their own backyards. Ruben also employs up to 30 laborers for his agri-business, helping provide employment for the local community. On top of this, he would sometimes offer financial assistance to the farmers when cassava is not yet in season, as he understood the financial challenges of small farmers in terms of capital. “Through LANDBANK’s assistance, we were able to expand our business and market. Currently, Agri de Oro VMB Marketing already distributes cassava chips to big companies like San Miguel Foods Corporation, Bounty Fresh Food, Inc., New YUNG Yang Felan Farm, and Agricola, to name a few,” Ruben added. More than just cassava trading, Ruben’s agri-business continues to support not only his own family, but also the small farmers, their families, and the local community. To date, LANDBANK has supported Agri de Oro VMB Marketing through financial assistance worth Php20 million, promoting inclusive growth especially in unbanked and underserved areas. LANDBANK provides financial assistance to agri-businessmen like Ruben, who are the unsung catalysts for countryside development and poverty alleviation. It is the biggest credit provider to small farmers and fishers, and microenterprises among government financial institutions. Last year, LANDBANK’s loans to the agriculture sector reached P236.31 billion, exceeding its yearend target of P231.25 billion. Of this amount, P44.82 billion were outstanding loans to small farmers, fishers, cooperatives, and farmers associations, while P191.49 billion were loans to other players in the agri-business value chain.

LEARN MORE

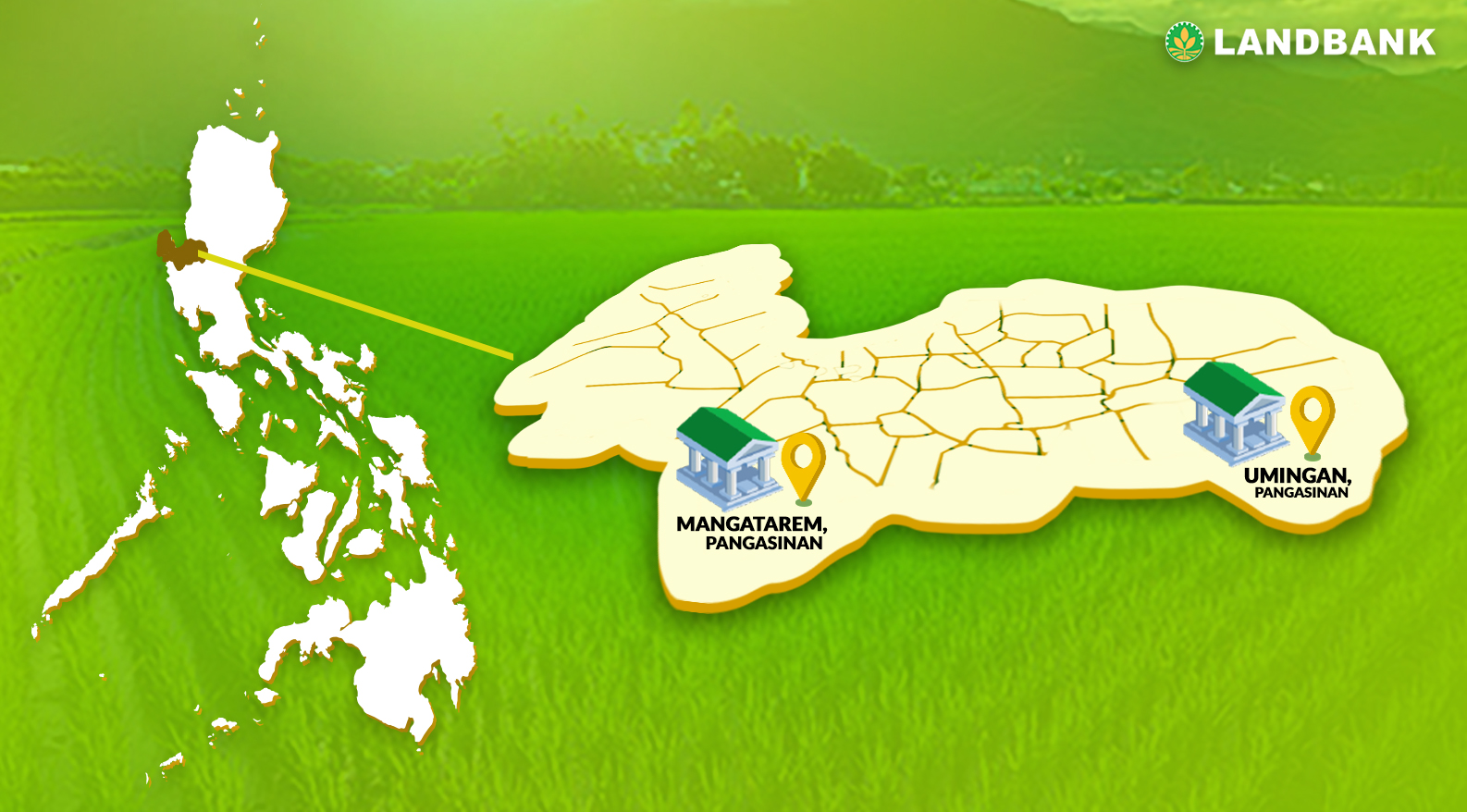

LANDBANK opens branches in Mangatarem and Umingan, Pangasinan

In line with bringing banking services closer to unbanked and underserved areas in the country, the Land Bank of the Philippines (LANDBANK) will officially inaugurate two new branches in Pangasinan—one in the Municipality of Umingan and the other in the Municipality of Mangatarem. LANDBANK is the first and only commercial Bank in Umingan serving a total of 79 barangays from the municipality and nearby San Quintin. The Mangatarem Branch serves clients from 82 barangays in the 1st class municipality, including 37 combined barangays from the neigboring municipalities of Aguilar and Urbiztondo. “LANDBANK’s continuous expansion in Pangasinan is a manifestation of our commitment to deliver innovative banking and financial services to Pangasinenses. This also forms part of our aggressive efforts to promote inclusive growth in the countryside, especially to farmers and fishers,” said LANDBANK President and CEO Cecilia C. Borromeo. LANDBANK now has a total of 12 major touchpoints in Pangasinan, with the two new branches joining those in Alaminos, Binalonan, Calasiao, Carmen, Dagupan, Lingayen, Mangaldan, San Carlos, Tayug, and Urdaneta. Both the Mangatarem and Umingan Branches had their soft openings last year, and will be inaugurated on March 5 and March 6, respectively. Network Expansion LANDBANK has 409 branches and extension offices, with 15 new branches to open this year, 8 of which will be in Mindanao. As of December 31, 2019, LANDBANK also has 2,195 Automated Teller Machines (ATMs) in 519 municipalities nationwide—63 of which are classified as unbanked areas—with 160 Cash Deposit Machines (CDMs). This year, an additional 150 new ATMs and 50 CDMs will be put-up. Meanwhile, the establishment of the Quirino and Lanao Lending Centers last year gives LANDBANK a total of 46 provincial lending centers nationwide, with eight more to be established this year. The Bank has 686 Point-of-Sale (POS) cash-out machines as of end-2019, which will be increased by 80 new terminals to be installed this year. LANDBANK also introduced the Agent Banking Program last year, and partnered with client cooperatives, associations, SMEs, and private entities to help provide basic banking services to far-flung areas. As of December 2019, 15 agent partners were accredited, operating in 13 unbanked municipalities and 6 areas previously without LANDBANK presence. The Bank is looking at onboarding 16 new agent banking partners this year to extend its reach and serve more unbanked and underserved areas.

LEARN MORE

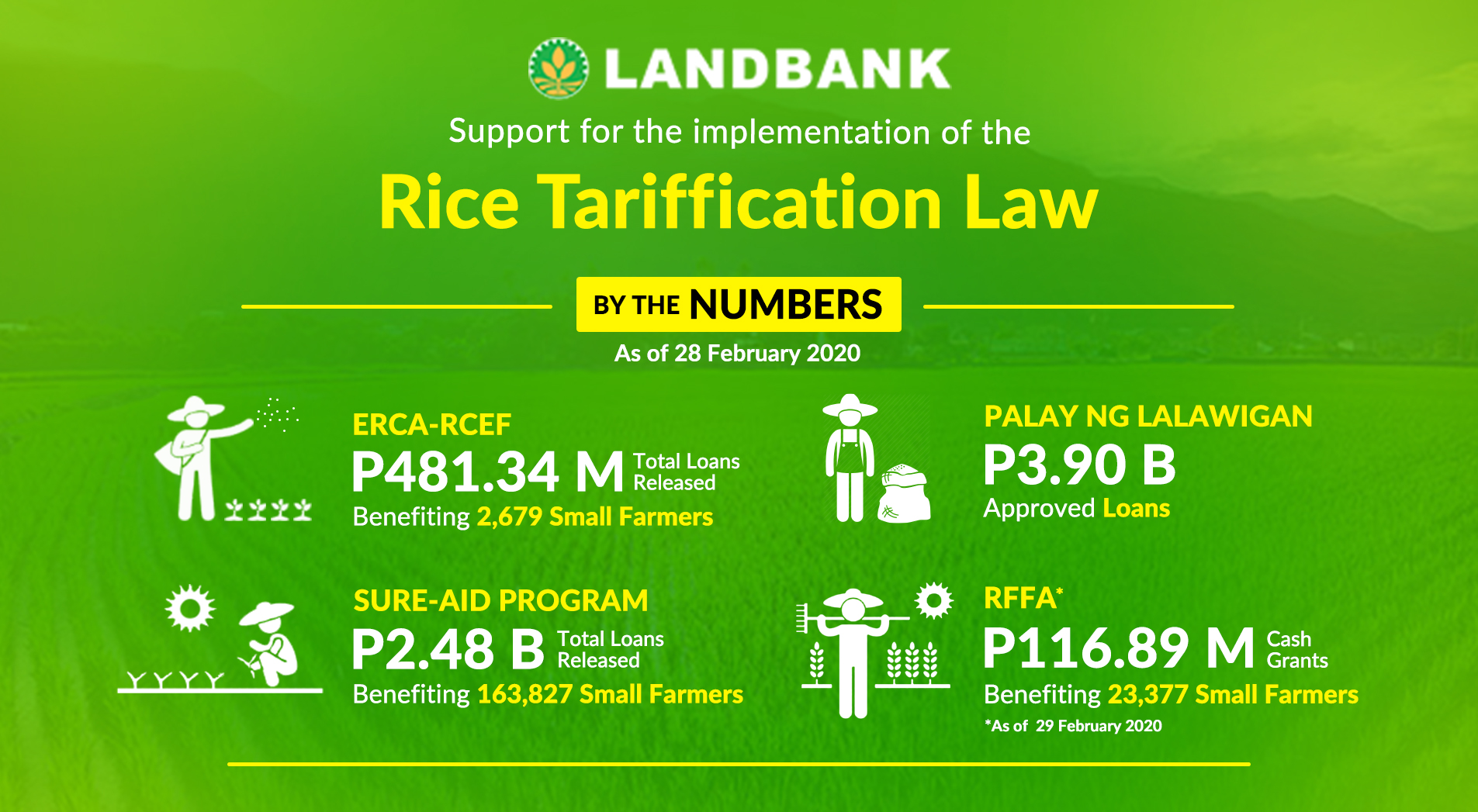

LANDBANK released P3.08B in support of the Rice Tariffication Law

One year into the implementation of the Rice Tariffication Law (RTL), Land Bank of the Philippines (LANDBANK), in partnership with the Department of Agriculture (DA), has released a total of P3.08 billion in loans and grants to 189,883 small farmers nationwide, and approved another P3.9 billion in loans to local government units (LGUs) to help them cope with the law’s initial impact on rice farmers. On February 14, 2019, President Rodrigo R. Duterte signed Republic Act No. 11203 entitled, “An Act Liberalizing the Importation, Exportation, and Trading of Rice, Lifting for the Purpose the Quantitative Import Restriction on Rice, and for Other Purposes,” otherwise known as the Rice Tariffication Law. As a direct response, LANDBANK and the DA initiated programs that helped mitigate the drop in the farmgate prices of palay. “Our farmers can rest assured that LANDBANK will continue to strengthen its support to the agriculture sector. Through partnerships with the Department of Agriculture and other agencies, we will continue to push for the advancement of our small farmers and fishers,” said LANDBANK President and CEO Cecilia C. Borromeo. One of the programs that LANDBANK supports is the Expanded Rice Credit Assistance under the Rice Competitiveness Enhancement Fund (ERCA-RCEF). The Bank is one of the implementing agencies for the P1-billion RCEF allocation for credit. From 2019 to 2024, LANDBANK will make P500 million in credit assistance available annually to rice farmers in 59 out of 81 rice-producing provinces covered by the Program at affordable interest rates and with minimum documentary requirements. As of February 28, 2020, a total of P481.34 million in loans was released to 2,679 eligible borrowers under the ERCA-RCEF. The second partnership program between LANDBANK and the DA is the Expanded Survival and Recovery Assistance Program for Rice Farmers (SURE Aid Program), which extended an immediate one-time, zero-interest, no collateral loan of P15,000 (net), payable in 8 years, to rice farmers who are tilling one hectare of land and below. Under the Program, a total of P2.48 billion in loans were provided to 163,827 small rice farmers in 69 provinces covered by the Program. Another special lending program launched by the Bank in 2019 in support of the RTL is the P10-billion PAlay aLAY sa Magsasaka ng Lalawigan (PALAY ng Lalawigan) Program to assist rice-producing provinces by enabling local government units (LGUs)—provincial, municipal and city governments—to procure palay produced by their local farmers, as well as to acquire farm machineries and post-harvest facilities. As of February 28, 2020, LANDBANK has approved P3.9 billion in loans to four (4) provincial LGUs. Lastly, LANDBANK once again partnered with the DA for the Rice Farmer Financial Assistance (RFFA) Program, a P3-billion unconditional cash transfer program which aims to give P5,000 financial assistance each to 600,000 rice farmers nationwide who are tilling 0.5 to 2 hectares of land. A total of P116.89 million in cash grants were released to 23,377 small farmers nationwide as of February 29, 2020.

LEARN MORE

From shore to soil: Former OFW plants success in mechanized farming

HAMTIC, Antique – Melbert Gabriel Fadrigo sailed oceans and seas for seven years before deciding to retire and return to his family’s rice and corn farm in this town. With the help of Land Bank of the Philippines (LANDBANK), Fadrigo availed of the Agricultural Competitiveness Enhancement Fund (ACEF) for the acquisition of his brand-new four-wheeled tractor with rotavator. “Sa una ang tingin mo sa farming, parang mahina ang kita. Pero habang tumatagal na, makikita mo na basta may tamang diskarte at equipment, malaki rin talaga ang kikitain. Bakit ka pa magbabarko kung yung kikitain mo dun, kikitain mo rin dito sa lupa?” Fadrigo explained. The youngest among three siblings, Fadrigo learned of the hardships that come with the manual tilling of land at an early age, accompanying his father plant rice and corn seeds in their 12-hectare agricultural land while he was still in high school. Back then, farming was laborious. Plowing a hectare of their land took two to three days using their trusted carabao. It also cost them more as their kuliglig or improvised tractors required more crude oil to run, more workers to operate, and more time needed to cultivate their land as compared to modern tractors. Before turning to full-time farming, Fadrigo first tried his luck as a cook in a cargo ship in 2010. Even then, he knew that his father needed someone who could continue their family’s legacy in farming. Fadrigo finally decided to take over the management of the family’s farm from his father in 2017. But he knew that he needed to adopt modern technology in order to increase their farm’s productivity. “Kinausap ko yung father ko na kumuha kami ng isang tractor kasi napaghuhulihan talaga kami kapag kuliglig ang gamit. Nung una nagbabayad pa kami sa isang co-op para maka-renta ng tractor. Doon namin nakita na iba talaga kapag may tractor ka dahil mas mabilis at maayos ang pagtatanim sa lupa,” Fadrigo explained. LANDBANK assisted Fadrigo in reaching for his aspiration to mechanize their farming methods. A year after he decided to become a full-time farmer, Fadrigo’s application for the ACEF program was approved by LANDBANK Antique Satellite Office, making him the first-ever ACEF availer in the province. This enabled him to procure the Php900,000-priced tractor. Since Fadrigo acquired the tractor, their productivity and income significantly increased. From spending two to three days for land preparation, they can now complete the job in just two hours for one hectare of land. Using his tractor, he was also able to earn extra income by servicing neighbouring farms in the localities of Hamtic, San Jose, Sibalom, and Tobias Fornier, which he charges for Php3,000 to Php6,000 depending on the land size. And since availing of the ACEF program, he has employed six regular farm workers to man their farm and operate their equipment. “Ang laking tulong talaga ng ACEF dahil dito nabili namin yung tractor, gumaan yung trabaho namin, at higit sa lahat lumaki ang kita namin. Kaya malaki ang pasasalamat ko sa LANDBANK sa tulong na nabigay nila sa amin,” Fadrigo shared. Moving forward, Fadrigo hopes to expand his business to rice trading by acquiring his own solar and mechanical dryers, and warehouse, also with the help of LANDBANK. The ACEF Lending Program is a joint program of the Department of Agriculture and LANDBANK which aims to provide necessary credit to farmers and fishers, their cooperatives and associations, and micro and small enterprises to increase their productivity, and to enhance the competitiveness of agricultural players. Interested borrowers may contact LANDBANK’s Programs Management Department I (PMD I) at tel. nos. 8-522-0000 locals 7450, 2992, 2804 or go to the nearest LANDBANK Lending Center, for more information.

LEARN MORE.jpg)

LANDBANK distributed P94B in cash grants for social protection programs

State-owned Land Bank of the Philippines (LANDBANK), in partnership with other government agencies, continued to be a conduit of the social protection programs of the national government as it released a total of P94.36 billion in cash grants to 9,670,434 beneficiaries in 2019 for this purpose. In partnership with the Department of Social Welfare and Development (DSWD), LANDBANK distributed a total of P73.94 billion to 4.4 million beneficiaries of the Conditional and Cash Transfer (CCT) Program, and P18.15 billion to 5.16 million beneficiaries of the Unconditional Cash Transfer (UCT) Program of the Department. The Bank also supported the Pantawid Pasada Program (PPP), a fuel subsidy program of the Department of Transportation (DOTr) and the Land Transportation Franchising and Regulatory Board (LTFRB) for jeepney drivers and operators, with a total of P2.27 billion released to 110,434 beneficiaries nationwide. “As LANDBANK aggressively pursues programs that intensifies our support to the agriculture sector, we have complemented this with our continuous efforts to support the national developmental agenda especially in alleviating poverty, and to fulfill our function as the main depository and servicing bank of the government,” said LANDBANK President and CEO Cecilia C. Borromeo. The identified beneficiaries under these social intervention programs were given LANDBANK ATM Cash Cards where cash grants are credited every two months for CCT, while the UCT and PPP are credited only upon the request of DSWD and LTFRB, respectively. Also in December last year, LANDBANK entered into a Memorandum of Agreement (MOA) along with 13 other government agencies for the Expanded Partnership Against Hunger and Poverty Program (EPAHP), designed to mitigate hunger, promote food security, and reduce poverty in the country by year 2030. The Bank committed P2 billion to lend to community-based organizations that supply the requirements for feeding programs.

LEARN MORE