Be in the know of the latest news and updates about LANDBANK.

LANDBANK, DA ramp-up ‘ayuda’ delivery to rice farmers

The LANDBANK Umingan Branch in Pangasinan facilitates the distribution of P5,000 cash aid to farmer-beneficiaries under the Rice Competitiveness Enhancement Fund - Rice Farmers Financial Assistance (RCEF-RFFA) Program. In partnership with the Department of Agriculture (DA), the Land Bank of the Philippines (LANDBANK) continues to ramp up the distribution of cash grants to farmer-beneficiaries under the Rice Competitiveness Enhancement Fund - Rice Farmers Financial Assistance (RCEF-RFFA) Program. As of 30 September 2022, LANDBANK has produced Intervention Monitoring Cards (IMCs) for 54,188 beneficiaries nationwide, of which 26,523 hail from the province of Pangasinan; 8,011 from Cagayan; 7,047 from Isabela; 7,204 from Sultan Kudarat; and the rest from the provinces of Tarlac, Pampanga and Camarines Sur. Through the LANDBANK IMCs, the beneficiaries are to receive P5,000.00 worth of cash assistance each to purchase needed farm inputs and boost agricultural productivity. In close coordination with the DA, LANDBANK has likewise opened accounts for another 118,857 farmer-beneficiaries for immediate production and distribution of their own LANDBANK IMCs. LANDBANK serves as the disbursing arm of the RCEF-RFFA Program, designed to provide responsive financial support to eligible farmer beneficiaries identified by the DA, as part of the implementation of Republic Act No. 11203 otherwise known as the Rice Tariffication Law (RTL).

LEARN MORE

LANDBANK, DHSUD build on partnership for accessible housing

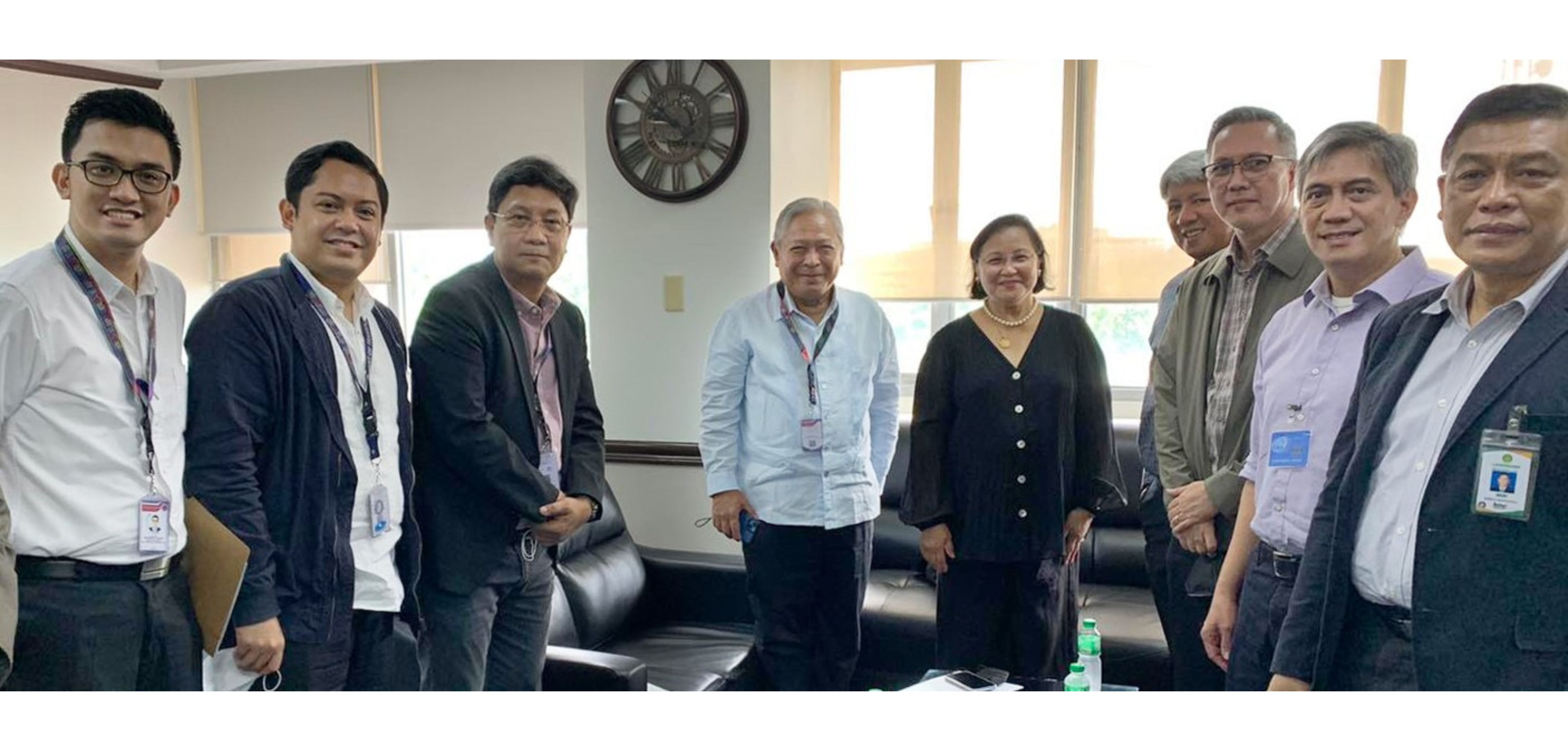

LANDBANK President and CEO Cecilia C. Borromeo (4th from right) pays a courtesy visit to Department of Human Settlements and Urban Development (DHSUD) Secretary Jose Rizalino L. Acuzar (5th from right) on 30 August 2022 to express support for the National Government’s intensified mass housing program. Joining them are DHSUD Undersecretary Robert Juanchito T. Dispo (6th from right), alongside LANDBANK Executive Vice Presidents Liduvino S. Geron (7th from right) and Julio D. Climaco, Jr. (3rd from right), Senior Vice Presidents Randolph L. Montesa (2nd from right) and Marilou L. Villafranca (rightmost), and Vice President Francisco E. Burgos Jr. (leftmost). Land Bank of the Philippines (LANDBANK) President and CEO Cecilia C. Borromeo paid a courtesy visit to Department of Human Settlements and Urban Development (DHSUD) Secretary Jose Rizalino L. Acuzar to express support for the national government’s inclusive thrust of expanding access to affordable housing for Filipinos. The officials explored opportunities for collaboration to attract development partners, such as private developers, Local Government Units (LGUs), banks, and other financial institutions, to invest in affordable housing construction. The meeting was also attended by DHSUD Undersecretary Robert Juanchito T. Dispo, together with LANDBANK Executive Vice Presidents Liduvino S. Geron and Julio D. Climaco, Jr., Senior Vice Presidents Randolph L. Montesa and Marilou L. Villafranca, and Vice President Francisco E. Burgos Jr. LANDBANK is providing DHSUD various digital banking services, including digital payment to suppliers through the LANDBANK weAccess, and viewing of account information and preparation of reports on issued checks through the LANDBANK electronic Modified Disbursement System (eMDS).

LEARN MORE

LANDBANK, BIR boost drive for digital tax collection

A contingent of senior officials led by LANDBANK President and CEO Cecilia C. Borromeo (3rd from left) pay a courtesy visit to BIR Commissioner Lilia C. Guillermo (4th from left) in line with the Bank’s continuing commitment to support modernized tax administration. The Land Bank of the Philippines (LANDBANK) expressed its continuous support for the Bureau of Internal Revenue’s (BIR) tax collection modernization efforts towards providing convenient services for taxpayers. LANDBANK President and CEO Cecilia C. Borromeo met with BIR Commissioner Lilia C. Guillermo on 05 October 2022, to explore meaningful avenues for collaboration to advance better tax administration. They were joined by LANDBANK Senior Vice Presidents Marilou L. Villafranca and Randolph L. Montesa, and other Bank officers. The state-run Bank supports the BIR through the LANDBANK Link.BizPortal facility, which provides taxpayers with a safe, reliable, and efficient online payment solution to conveniently pay their taxes, among other digital banking services. The LANDBANK Link.BizPortal allows customers to pay tax liabilities online via the BIR or LANDBANK websites, thereby eliminating the need to physically wait in line at BIR regional and district offices. From January to August 2022, the LANDBANK Link.BizPortal has facilitated for the BIR over 548,000 transactions with a total value of P1.4 billion.

LEARN MORE

LANDBANK, DOTr reinforce ties to modernize transport sector

LANDBANK President and CEO Cecilia C. Borromeo (5th from right) pays a courtesy visit to Transport Secretary Jaime J. Bautista (6th from right) to reaffirm the Bank’s continuing commitment to the National Government’s transport modernization agenda. Joining them are DOTr Undersecretaries Cesar B. Chavez (7th from right), Atty. Timothy John R. Batan (8th from right), Kim Robert C. De Leon (9th from right), LANDBANK Executive Vice Presidents Alex A. Lorayes (3rd from right) and Liduvino S. Geron (4th from right), and LANDBANK Senior Vice Presidents Randolph L. Montesa (2nd from right) and Ramon R. Monteloyola (rightmost). The Land Bank of the Philippines (LANDBANK) renewed its commitment to the Department of Transportation (DOTr) to fully support programs that provide a more efficient, convenient, and modern public transportation for Filipino commuters. During a courtesy visit on 02 September 2022, LANDBANK President and CEO Cecilia C. Borromeo met with DOTr Secretary Jaime J. Bautista to discuss ongoing and potential collaboration programs and initiatives to advance the country’s transport sector. The LANDBANK and DOTr are partners for the Automated Fare Collection System (AFCS) Pilot Production Testing (PPT), which allows the convenient use of EMV contactless credit, debit and prepaid bank cards as cashless payment instruments in public transport modes. Only LANDBANK contactless cards will be accepted as fare media for the interim implementation. Once the necessary regulations or policies have been issued, the LANDBANK AFCS solution can also accept and process the EMV contactless cards issued by other local and foreign banks. In preparation for its full and commercial implementation, LANDBANK and the DOTr launched the AFCS in September, covering six (6) units of modern public utility vehicles (MPUVs) of PM Jeepney Drivers Operators and Services, Inc. (PMJDOSI). The remaining 144 MPUV units out of the total 150 PUV units shall soon be deployed in selected pilot sites in NCR, Central Luzon, Calabarzon, and Metro Cebu. The state-run Bank likewise offers the Support Package for Environment-friendly and Efficiently-Driven PUV (SPEED PUV) Program, to help finance the shift of public transport operators to modern, safer and eco-friendlier vehicles. Under the SPEED PUV Program, public transport cooperatives and corporations may avail loans for the purchase of modern public utility jeepneys (PUJs). LANDBANK can finance up to 95% of the PUJ’s total cost at an affordable interest rate of 6% per annum, payable based on cash flow but not to exceed a maximum of seven (7) years. The National Government, through the Land Transportation Franchising and Regulatory Board (LTFRB), also offers P160,000.00 subsidy to borrowers for each PUJ financed under the Program. As of end-August 2022, LANDBANK has approved P5.3 billion in loans to 116 borrowers under the SPEED PUV Program.

LEARN MORE

LANDBANK, UNICEF join hands to extend pre-disaster aid

LANDBANK President and CEO Cecilia C. Borromeo (3rd from right) and UNICEF Philippines Representative Oyunsaikhan Dendevnorov (4th from right) sign a banking services agreement on 06 October 2022, for the pilot run of the United Nations Central Emergency Response Fund (CERF) for Anticipatory Action. They are joined by UNICEF Deputy Representative for Programs Behzad Noubary (leftmost) and Deputy Representative for Operations Thomas Meyerer (5th from right), and LANDBANK Senior Vice President Marilou L. Villafranca (2nd from right) and Assistant Vice President Domingo Conrado G. Galsim (rightmost). The Land Bank of the Philippines (LANDBANK) and the United Nations Children’s Fund (UNICEF) signed a partnership agreement to ensure the smooth and speedy disbursement of pre-disaster financial aid to some 22,000 families in typhoon-prone towns. LANDBANK President and CEO Cecilia C. Borromeo and UNICEF Philippines Representative Oyunsaikhan Dendevnorov led the ceremonial signing for a banking services agreement for the pilot run of the United Nations Central Emergency Response Fund (CERF) for Anticipatory Action on 06 October 2022 at the UNICEF Philippines Office in Mandaluyong City. They were joined by UNICEF Deputy Representative for Programs Behzad Noubary and Deputy Representative for Operations Thomas Meyerer, alongside LANDBANK Senior Vice President Marilou L. Villafranca, and Assistant Vice Presidents Domingo Conrado G. Galsim and Renato R. Aquino. Under the agreement, LANDBANK shall open an account on behalf of UNICEF for deposit and maintenance of funds among various banking services, including the crediting of multi-purpose cash transfers to the LANDBANK Prepaid Cards of identified Conditional Cash Transfer (CCT) Program beneficiaries. “LANDBANK brings to the table our expertise as the distribution arm of the National Government’s social protection programs. This includes our extensive experience of delivering cash grants to the target sectors under the CCT and UCT (Unconditional Cash Transfer) programs covering 10 million beneficiaries nationwide,” said LANDBANK President and CEO Borromeo. UNICEF Philippines Representative Dendevnorov said that the anticipatory approach reduces the costs of humanitarian response and allows affected populations to make informed decisions ahead of a humanitarian crisis. “In this context, we can say that cash transfers provided through Financial Service Providers (FSPs) like LANDBANK can improve the speed, efficacy and security of humanitarian aid delivery,” said UNICEF Philippines Representative Dendevnorov. Target beneficiaries under the pilot CERF for Anticipatory Action include families residing in the municipalities of Baras, Bato, San Andres and Virac in Catanduanes, as well as the municipalities of Catarman, Catubig, Gamay, Mondragon, and San Roque in Northern Samar. The cash assistance worth P1,000 for each CCT beneficiary will be disbursed via LANDBANK Prepaid Cards, three days before the expected landfall of a Category 4 or 5 typhoon. Beneficiaries can use the prepaid cards to withdraw cash assistance from LANDBANK automated teller machines (ATMs) and Agent Banking Partners, and make cashless purchases in groceries and drugstores via point-of-sale (POS) terminals. LANDBANK recently upgraded the existing prepaid cards of the CCT beneficiaries into transaction accounts with expanded features to provide more convenient banking services, including cash card loading via LANDBANK branches, fund transfers through the LANDBANK Mobile Banking App, and cash-in via LANDBANK Cash Deposit Machines.

LEARN MORE

LANDBANK deploys Mobile ATMs in typhoon-hit Nueva Ecija

(Lower photo courtesy of the Philippine Air Force) NUEVA ECIJA – The Land Bank of the Philippines (LANDBANK) deployed two (2) mobile automated teller machines (ATMs) in the Municipalities of Sta. Rosa and Cuyapo to respond to the emergency banking needs of residents, following the damage and disruption caused by the recent super typhoon “Karding.” A LANDBANK Mobile ATM was deployed to the Municipal Hall of Sta. Rosa on September 29, 2022, to serve the urgent cash requirements of locals in the area. Meanwhile, another Mobile ATM was stationed at the Municipal Hall of Cuyapo the following day, September 30, 2022, in time for the payroll date of municipal employees and other LANDBANK customers. The LANDBANK Mobile ATMs are designed to be deployed in areas with disrupted or limited access to banking services due to disasters or calamities, in line with LANDBANK’s commitment to provide unhampered banking services. As of 03 October 2022, LANDBANK operates a total of 20 Mobile ATMs nationwide.

LEARN MORE

LANDBANK assures available climate finance for adaptation, mitigation

LANDBANK President and CEO Cecilia C. Borromeo (2nd from left) and other LANDBANK senior officials join Albay Representative Joey S. Salceda (3rd from left) and National Security Adviser Secretary Clarita R. Carlos (leftmost) at the Disaster and Climate Emergency Policy Forum on 22 September 2022, to discuss strategies and interventions to combat climate change. The Land Bank of the Philippines (LANDBANK) assures local development stakeholders of continued access to climate finance under the Green Climate Fund (GCF), in support of projects for climate change adaptation and mitigation. The state-run Bank expressed its continuous commitment in contributing to address the climate crisis at the Disaster and Climate Emergency Policy Forum on 22 September 2022, organized by the Local Climate Change Adaptation for Development (LCCAD), University of the Philippines Resilience Institute (UPRI), 4K Foundation, Komunidad Global, Albay Embassy and Climate Change Commission (CCC), in partnership with the House of Representatives and the Office of Albay Rep. Joey S. Salceda. “LANDBANK stands ready to extend necessary credit assistance to boost national and local resiliency and adaptive capacity to climate change. We are collaborating with various development partners, such as the GCF, towards building a more sustainable future,” said LANDBANK President and CEO Cecilia C. Borromeo. The GCF is an operating entity of the financial mechanism of the United Nations Framework Convention on Climate Change (UNFCCC) and Paris Agreement, dedicated to support global efforts to respond to the challenge of climate change. The program aims to help developing countries limit or reduce greenhouse gas (GHG) emissions and adapt to climate change, by supporting programs and projects that promote a paradigm shift to low-emission and climate-resilient development. As a Direct Access Entity (DAE) of the GCF, LANDBANK channels grants and loans provided by the GCF to finance local projects that aim to mitigate and adapt to climate change. The Bank leads the project development, management, monitoring and evaluation, in partnership with public and private entities. In April of this year, LANDBANK and the Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAG-ASA) under the Department of Science and Technology (DOST) started the implementation of the very first GCF-approved project in the country. The GCF project titled, “The Multi-Hazard Impact-Based Forecasting and Early Warning System,” aims to shift from a traditional hazard-based to an impact-based forecasting and early warning system, to help the public take pre-emptive measures and improve disaster risk reduction in the long run. The project will benefit communities in the disaster-prone areas of Palo, Leyte; New Bataan, Davao de Oro; Tuguegarao City, Cagayan; and Legazpi City, Albay. LANDBANK is proposing for GCF approval eight other projects designed to promote climate change mitigation, adaptation and resiliency in the sectors of agriculture, health, transportation, renewable energy and energy efficiency, water resource management and ecosystem management. LANDBANK’s contribution to the GCF underscores its commitment to sustainable development and environmental protection, alongside facilitating the uninterrupted delivery of financial services to key economic development sectors. In his first address at the UN General Assembly on 21 September 2022 (Tuesday, September 20, New York Time), President Ferdinand R. Marcos, Jr. also urged developed countries to extend climate financing to countries that are most vulnerable to climate change.

LEARN MORE

LANDBANK AgriSenso puts spotlight on affordable financing for agri players

(clockwise from upper left) LANDBANK Program Management Department I Head, Assistant Vice President Edgardo S. Luzano, together with Kuvi Integrated Farm owner Rogelio T. Giangan, Cagayan rice farmer Vanessa Morillo, and Dampe Palay and Sugarcane Producers Cooperative Chairperson Rodolfo H. Medina, leads the third run of the LANDBANK AgriSenso Virtual Forum, which puts the spotlight on the legislated programs jointly implemented by LANDBANK and the Department of Agriculture (DA) to support individual farmers and fishers and other agriculture players. State-run Land Bank of the Philippines (LANDBANK) remains aggressive in extending affordable financing for individual farmers and fishers, and other players in the agriculture value chain through loan programs jointly implemented by the Bank with the Department of Agriculture (DA). The third run of the LANDBANK AgriSenso Virtual Forum on 19 September 2022 featured loan availers, namely Kuvi Integrated Farm owner Rogelio T. Giangan from North Cotabato, rice farmer Vanessa Morillo from Sto. Niño, Cagayan, and Dampe Palay and Sugarcane Producers Cooperative Chairperson Rodolfo H. Medina from Floridablanca, Pampanga, who shared how their productivity and income improved following the financial support from LANDBANK and DA. LANDBANK Program Management Department I Head, Assistant Vice President Edgardo S. Luzano discussed available financing with as low as 2% annual interest rate for individual farmers and fishers and their cooperatives and associations, as well as for micro and small enterprises (MSEs). Under the Agricultural Competitiveness Enhancement Fund (ACEF) Lending Program, LANDBANK provides credit assistance for the purchase of farm inputs and acquisition of agricultural fixed assets. The loanable amount for individual farmers and fishers is up to P1 million, while cooperatives, associations and MSEs may borrow a maximum of P5 million. As of 31 August 2022, the Bank has released a total of P8.1 billion in loans to over 35,500 borrowers under the ACEF Lending Program. LANDBANK also implements the Expanded Rice Credit Assistance under the Rice Competitiveness Enhancement Fund (ERCA-RCEF), which aims to help increase the productivity, efficiency and profitability of rice farmers and their cooperatives. Eligible program borrowers may avail of up to 90% of their total project cost. Since the implementation of ERCA-RCEF in 2019, a total of P1.7 billion in loans has been released to more than 5,700 borrowers, including 46 cooperatives and associations that assisted over 18,300 farmers and fishers. In support of the development of the country’s sugar industry, LANDBANK is also implementing the Socialized Credit Program under the Sugarcane Industry Development Act (SCP-SIDA). This facility is made available to individual sugarcane farmers, cooperatives, associations and common service centers, to finance up to 90% of their total project cost or financing requirement. As of end-August 2022, the Bank’s loan releases under SCP-SIDA amounted to P612.3 million for 2,651 borrowers, benefiting over 6,700 sugarcane farmers. The next run of the AgriSenso Virtual Forum will be held on 26 September 2022 to discuss other lending programs designed for small farmers and fishers, and agrarian reform beneficiaries (ARBs).

LEARN MORE

LANDBANK, Bongabong LGU lead groundbreaking of Agri-Hub

Bongabong Municipal Mayor Elegio A. Malaluan (5th from left) and Vice Mayor Richard S. Candelario (4th from left), together with LANDBANK representatives, lead the groundbreaking ceremony at the LGU municipal compound on 6 September 2022. The activity was witnessed by LGU officials and several local businessmen from the Municipality. BONGABONG, Oriental Mindoro – To better serve the requirements of farmers and fishers, a Land Bank of the Philippines (LANDBANK) Agri-Hub will soon rise at the compound of the Municipal Government of Bongabong. Bongabong Mayor Elegio A. Malauan, together with LANDBANK Oriental Mindoro Lending Center Head, Assistant Vice President Edwin Roel Ramos; Calapan San Vicente Branch Head, Department Manager Ferdinand E. Abas; and Pinamalayan Branch Head Lizza Mae D. Camposano, led the groundbreaking ceremony on 6 September 2022. Mayor Malauan expressed his gratitude to LANDBANK, as the new touchpoint in the locality will spur local economic growth and development—which are priorities under his administration. “The establishment of this Agri-Hub is a testament to our continued commitment to serve key players in the agribusiness value chain. We hope to generate more economic opportunities and activities in the Municipality and nearby areas,” LANDBANK President and CEO Cecilia C. Borromeo said. The construction of the LANDBANK Bongabong Agri-Hub is set to commence within the month and expected to be inaugurated in late December 2022, in addition to the Bank’s 10 existing Agri-Hubs nationwide. The Bongabong Agri-Hub will provide accessible financial services mainly to the 12,233 farmers and fishers in the Municipality, to complement the nearest LANDBANK Lending Center in Calapan City. The Agri-Hub will also deliver banking services to public and private clients of the Bank, including 5,360 beneficiaries of National Government’s Conditional and Unconditional Cash Transfer (CCT/UCT) Programs in the Municipality. The LANDBANK touchpoint will be equipped with various digital banking platforms, including the Digital Onboarding System (DOBS), which simplifies the account opening process for new clients to only 10-15 minutes.

LEARN MORE

LANDBANK launches convenient mobile app for commuters

In line with the modernization of the country’s transport sector, the Land Bank of the Philippines (LANDBANK) is now offering a mobile transit app for cashless and contactless payment in public utility vehicles (PUVs) equipped with the Automated Fare Collection System (AFCS) EMV solution. Through the LANDBANK mCommuter app, commuters can conveniently pay for transportation fares in AFCS-enabled vehicles by scanning the app-generated Quick Response (QR) Code, or by simply tapping their smartphones capable of supporting Near-Field Communication (NFC) technology on payment terminals. “The LANDBANK mCommuter app supports the government’s transport modernization agenda, geared towards enhancing the daily travel experience of commuters. This is part of our continued efforts to leverage digital technology to serve commuter needs,” said LANDBANK President and CEO Cecilia C. Borromeo. To register and access the features of the mCommuter app, users must be Full Wallet Accountholders of LANDBANKPay—the Bank’s all-in-one mobile wallet. Once registered in mCommuter, fares will be automatically debited from the user’s LANDBANKPay account. Users may also link their LANDBANK EMV contactless prepaid and credit cards to the app to monitor their transit payment transactions and passenger journey. Other mCommuter features scheduled for future roll-out include advance booking of tickets and discounted fares in PUV units. Starting 13 September 2022, the mCommuter app is free to download in the Google Play Store, and soon in the Apple App Store. LANDBANK and the Department of Transportation (DOTr) recently launched the interim operation of the AFCS in September, covering six (6) units of modern public utility vehicles (MPUVs) of PM Jeepney Drivers Operators and Services, Inc. (PMJDOSI). The remaining 144 MPUV units out of the total 150 PUV units shall soon be deployed in selected pilot sites in NCR, Central Luzon 3, Calabarzon, and Metro Cebu. Aside from the mCommuter app, LANDBANK contactless cards may also be used as cashless payment instruments in AFCS-enabled PUV units.

LEARN MORE

Estrella, Borromeo approve IRR on agrarian debt moratorium

Land Bank of the Philippines (LANDBANK) President and CEO Cecilia C. Borromeo and Agrarian Reform Secretary Conrado M. Estrella III hold the signed implementing rules and regulations (IRR) for Executive Order No. 4 Series of 2022. In compliance with the directive of President Ferdinand R. Marcos, Jr., Agrarian Reform Secretary Conrado M. Estrella III and Land Bank of the Philippines (LANDBANK) President and CEO Cecilia C. Borromeo, today, September 28, 2022, signed the Joint Administrative Order providing the implementing rules and regulations (IRR) for Executive Order No. 4 Series of 2022, which declares a moratorium on the payment of land amortization and interests for agrarian reform beneficiaries. Signed by the President on September 13, 2022, the EO entitled, “Directing the Implementation of a Moratorium on the Payment of the Principal Obligation and Interest of the Amortization Due and Payable by Agrarian Reform Beneficiaries,” calls for a one-year moratorium on loan payments of Agrarian Reform Beneficiaries (ARBs) who received agricultural land under the Comprehensive Agrarian Reform Program (CARP). “It is our duty in the government to prioritize the farmers, not only because they are the ones who keep us alive, but because they will make our economy rise again,” the President said. The IRR signed by the Department of Agrarian Reform (DAR) and LANDBANK specifies that the one-year moratorium covers the payment of the Principal Value and the Annual Interest Due and payable by the ARBs. “The one-year moratorium period will provide the needed time for Congress to pass the law condoning the existing agrarian reform loans for the current ARBs and free land distribution for future beneficiaries,” Estrella said. It primarily covers the financial obligation to pay the total cost of the land under Presidential Decree No. 27, including interest at the rate of six percent (6%) per annum as provided under Section 6 of E.O. No. 228; and the financial obligation to pay the principal value including the six percent (6%) annual interest of the thirty (30)-year land amortization of the ARBs under Section 26 of RA No. 6657, as amended. “LANDBANK supports this historic initiative which is now taking off. We will provide immediate financial relief to ARBs nationwide, and yield positive results towards ensuring food security in the country,” said LANDBANK President Borromeo. LANDBANK serves as the collection agent of the National Government for land amortizations from ARBs, pursuant to its mandate as the financial intermediary of the CARP. All collections are remitted by the Bank to the Bureau of the Treasury (BTr) as part of the revenue of the National Government. The DAR-LANDBANK Joint Administrative Order covers the identification of beneficiaries qualified to avail of the one-year payment suspension, with the impact of the initiative to enhance the productivity and profitability of the ARBs duly documented and promoted. EO No. 4 directs the DAR and LANDBANK to jointly submit to the Office of the President, through the Office of the Executive Secretary, a comprehensive report on the implementation of this Order, including data on the number of ARBs actually covered and impact of the moratorium, among others. The DAR-LANDBANK Joint Administrative Order shall take effect upon publication in the Official Gazette or in a newspaper of general circulation.

LEARN MORE

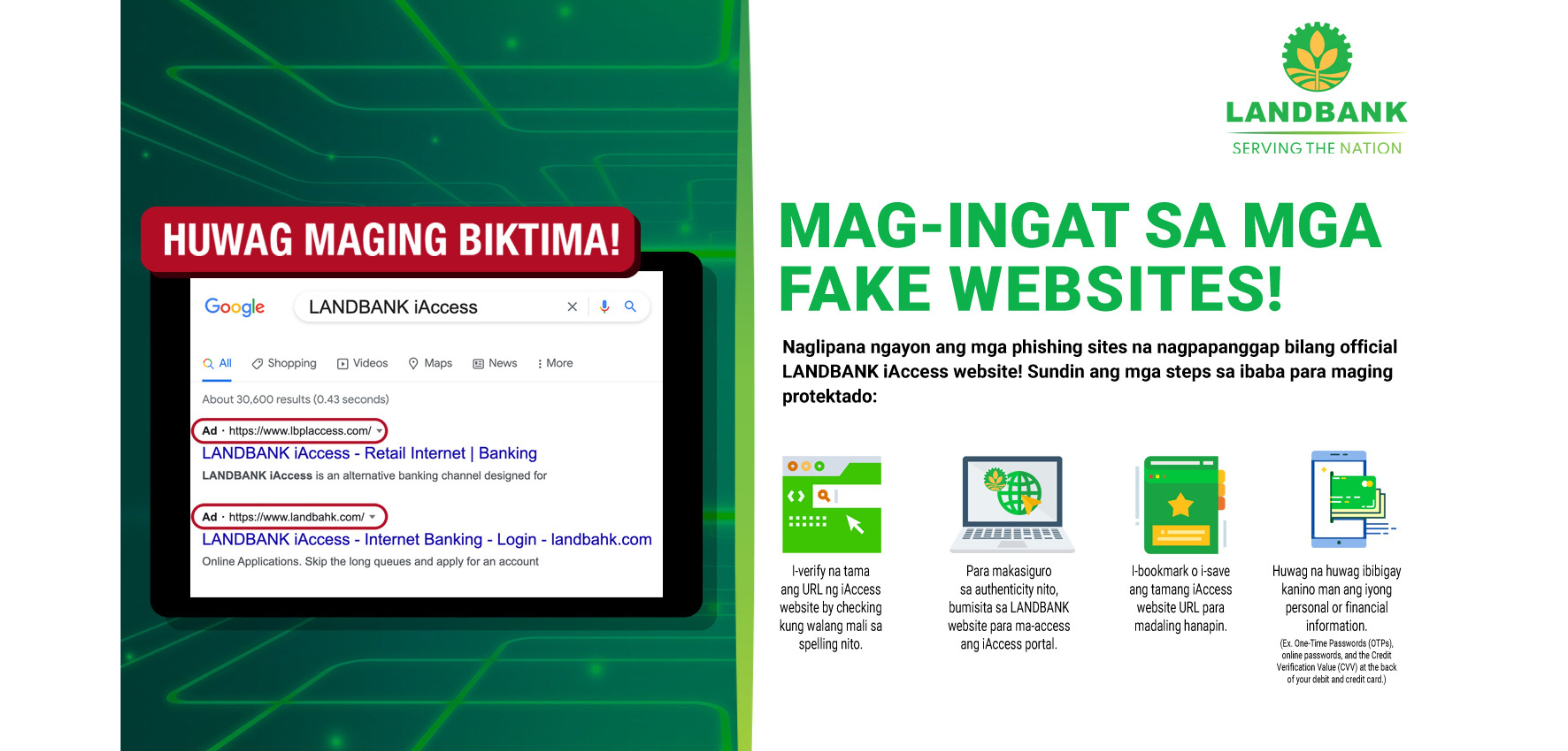

LANDBANK: Beware of scams using fake leads on Google Ads

The Land Bank of the Philippines (LANDBANK) is warning customers and the general public of an online scam that is using Google Ads that lead to a fake LANDBANK phishing website, designed to steal personal and financial information. LANDBANK has not placed any ads on Google. The Bank is currently working with Google to bring down these misleading ads the soonest time possible. For your security, the public is advised to directly visit the official LANDBANK website (www.landbank.com) and use the available URLs/links located in the website to access the Bank’s digital banking channels, including the official iAccess website (www.lbpiaccess.com). The LANDBANK Mobile Banking App (MBA) can also be used for safer online transactions. The Bank also reminds the public to be more critical of phishing websites masquerading as official LANDBANK websites, and to remain vigilant against phishing scams and all other forms of online banking fraud. Please do not open suspicious emails, links and attachments, and never share your account and personal information to anyone. Official LANDBANK representatives will never ask for critical financial and banking information from our customers. LANDBANK customers may report fraudulent activities to their respective handling Branch or through the LANDBANK Customer Care Hotline through (02) 8-405-7000 or 1-800-10-405-7000, or via email at customercare@mail.landbank.com.

LEARN MORE