Be in the know of the latest news and updates about LANDBANK.

LANDBANK empowers woman-entrepreneur to grow Cagayan store

LANDBANK assisted entrepreneur Ginalyn Joaquin to expand her tricycle ‘rolling store’ (left photo) into a full grocery store in Tuao, Cagayan (right photo). TUAO, Cagayan – Ginalyn Joaquin always dreamt of running her own retail store, similar to the ‘sari-sari store’ her mother used to own when she was a child. But having enough resources to pursue this dream proved to be difficult as her monthly salary was barely enough to make ends meet for the needs of her family. Working as a full-time employee at a sugar milling company, Ginalyn’s salary was just enough to cover their family’s daily living expenses. And when her daughter contracted a serious illness and needed medical care, Ginalyn was forced to look for additional sources of income to afford the health care costs. While keeping her day job, Ginalyn started buying sugar from her employer, which she repacked in smaller amounts and sold to her neighbors. This retail initiative soon evolved into a ‘rolling store’ aboard a tricycle, wherein she sold other essential grocery items across town, including the neighboring municipality of Piat. Through hard work, Ginalyn was able to pay for her daughter’s health care and eventually, was financially stable to resign from her day job and focus on her store. Ginalyn’s business—JP’s Enterprises—continued to grow and was tapped by a noodle brand as an official distributor in the province. However, this required additional working capital, which she did not have at that time. Ginalyn then turned to the Land Bank of the Philippines (LANDBANK) for credit assistance amounting to P30 million under the Emerging Female-Initiated Livelihood and Investment Projects via INclusive Financing to Accelerate Entrepreneurial Growth (FILIPINA) Lending Program, to finance the working capital for JP’s Enterprises. The LANDBANK loan helped Ginalyn expand her business into a full grocery store and become a leading supplier of grocery items in Cagayan, catering to the towns of Tuao, Piat, Sanchez-Mira and Santo Niño, as well as the municipalities of Kabugao and Conner in the province of Apayao. It was also able to generate employment for around 102 locals, a significant increase from the initial 2 workers Ginalyn hired for her previous rolling store. At the height of the COVID-19 pandemic, the grocery store remained open to service customers, and was even tapped by local government units in the province as a supplier of relief goods. “Nagpapasalamat ako sa LANDBANK sa pagkakaroon ng tiwala sa akin at sa business ko. Malaking tulong ang pagkakaroon nila ng programa na sumusuporta sa mga babaeng negosyante tulad ko,” said Ginalyn. Through the Emerging FILIPINA Lending Program, LANDBANK aims to support and empower female entrepreneurs to pursue business ventures such as traditional trade, e-commerce business and food services activities, among others. The Program can finance the working capital, construction or renovation of buildings and facilities related to business operations, and financing of purchase orders from the borrower’s clients. For cooperatives and partner financial institutions, rediscounting and on-lending activities may also be financed. Eligible borrowers include registered micro, small and medium enterprises (MSMEs) majority-owned by women or with majority of its top management, including the Chief Executive Officer (CEO), composed of women. They may borrow up to 80% of the actual project cost and 85% for rediscounting and on-lending activities. Short-term loans and term loans for permanent working capital are payable up to one (1) year and five (5) years, respectively, while term loans for fixed assets and construction of facilities are payable up to ten (10) years. An interest rate of 5% per year shall apply, fixed for the first three (3) years and subject to repricing thereafter. As of end-June 2022, LANDBANK has extended P37.8 million to support five borrowers under the Emerging FILIPINA Lending Program, with the Bank’s outstanding loans to MSMEs totaling P46.6 billion to more than 6,000 borrowers. Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate to promote inclusive and sustainable development. On 8 August 2022, the state-run Bank celebrated its 59th anniversary, representing almost six decades of service to the nation.

LEARN MORE

LANDBANK offers online, OTC placements for BTr’s RTB-28

The Land Bank of the Philippines (LANDBANK) is offering to the investing public the Bureau of the Treasury’s (BTr) 28th Tranche of the Retail Treasury Bonds or RTB-28 with Exchange Offer, starting today (23 August 2022) until 02 September 2022. This forms part of the state-run Bank’s support to the National Government’s thrust of promoting financial inclusion and literacy, while boosting the state’s coffers for various recovery and development projects. Finance Secretary Benjamin E. Diokno, Treasurer of the Philippines Rosalia V. De Leon, and LANDBANK President and CEO Cecilia C. Borromeo led the launch of the latest retail bond offer at the BTr’s Ayuntamiento Building in Manila, with the theme, “Tulong-Sulong sa Pagbangon.” “LANDBANK is once again proud to be the Joint Lead Issue Manager of this latest offering, which reflects the National Government’s continuous thrust in fostering financial inclusivity. It offers Filipinos a safe and secure opportunity to invest hard-earned money, while taking part in nation-building,” said President and CEO Borromeo. The RTB-28 is a five-and-a-half-year bond designed for retail investors as a low-risk and higher-yielding savings instrument. Proceeds of the issuance will help strengthen the country’s agriculture sector, infrastructure, and education and healthcare systems, among others. Interested investors may conveniently purchase RTB-28 for a minimum investment of P5,000 and integral multiples of P5,000 thereafter using the LANDBANK Mobile Banking App, in as fast as five minutes or less. This feature is also available in the Mobile Banking App of the Overseas Filipino Bank (OFBank), the official digital bank of the Philippine government and a subsidiary of LANDBANK. Investors of RTB-28 can also make online placements through the BTr Online Ordering Facility and settle the payments via the LANDBANK Link.BizPortal online payment platform. Over-the-counter placements are likewise accepted in all LANDBANK branches nationwide. Holders of previously issued bonds, namely FXTN 10-57, RTB 5-11, FXTN 10-58, and RTB 3-10, may also exchange and reinvest their bond holdings for the latest bond offer. LANDBANK is the Joint Lead issue Manager of RTB-28, with settlement scheduled on 07 September 2022. Interest payments will be paid quarterly during the term of the bond. The National Government through the BTr has been issuing RTBs since 2001 as part of its efforts to support financial inclusion and literacy among Filipinos by making government securities more accessible to small investors. Last February 2022, LANDBANK generated a total of P87.8 billion in sales for the previous Retail Treasury Bonds Tranche 27 or RTB-27 issuance. Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate to promote inclusive and sustainable development. On 8 August 2022, the state-run Bank celebrated its 59th anniversary, representing almost six decades of service to the nation.

LEARN MORE

LANDBANK mounts first ‘AgriSenso’ virtual forum

(clockwise from upper left) Finance Secretary and LANDBANK Chairman Benjamin E. Diokno and LANDBANK President and CEO Cecilia C. Borromeo lead the very first LANDBANK AgriSenso Virtual Forum, together with Department of Agriculture Assistant Secretary and Bureau of Animal Industry Officer-in-Charge Director Reildrin G. Morales, United Broiler Raisers Association President Atty. Elias Jose M. Inciong, Ana’s Breeders Farms, Inc. President and CEO Jonathan O. Suy, and LANDBANK Program Management Department I, Assistant Vice President Edgardo S. Luzano. As part of its intensified support to the agriculture sector, the Land Bank of the Philippines (LANDBANK) kicked off a series of virtual forums to discuss with local agri players opportunities towards modernizing the industry, while also ensuring food security. Finance Secretary and LANDBANK Chairman Benjamin E. Diokno and LANDBANK President and CEO Cecilia C. Borromeo led the first run of the LANDBANK AgriSenso Virtual Forums on 15 August 2022, which gathered contract grower-investors, integrators, and other key players from the poultry industry. “Through the AgriSenso Virtual Forums, we hope to sustain our engagement with agri stakeholders from all over the country, and to foster greater collaboration. LANDBANK continues to service the development requirements of the agricultural sector through accessible and responsive lending programs,” said President and CEO Borromeo. The AgriSenso Virtual Forums also address the request of customers to learn more about the Bank’s available credit facilities, as noted during the Online Stakeholder’s Consultation Forum conducted by the Bank last year. “LANDBANK is at the forefront of supporting key players in the agriculture sector by ensuring that the entire agri value chain has access to much-needed credit and other financial services. How to access the services to meet your diverse needs is, hopefully, what you can take away from today’s forum,” said Secretary Diokno to the forum’s participants. Each session of the AgriSenso Virtual Forums will focus on a specific agriculture industry, with industry experts and players invited to share insights and successful initiatives, as well as the development plans of the government for each industry. The first LANDBANK AgriSenso Virtual Forum put the spotlight on the poultry industry and featured United Broiler Raisers Association President Atty. Elias Jose M. Inciong and Ana’s Breeders Farms, Inc. (ABFI) President and CEO Jonathan O. Suy, who shared about challenges facing the industry and innovative ways to meet consumers’ evolving needs. Meanwhile, Department of Agriculture Assistant Secretary and Bureau of Animal Industry Officer-in-Charge Director Reildrin G. Morales discussed the National Government’s development roadmap for the local poultry sector. LANDBANK Poultry Lending Program For his part, LANDBANK Program Management Department I, Assistant Vice President Edgardo S. Luzano discussed the Bank’s Poultry Lending Program, designed to help promote sustainable and competitive poultry production. The Lending Program offers financial support to qualified cooperatives, micro, small and medium enterprises, large agri-business enterprises and corporations for the production of broilers, layers, breeders, ducks, quails, ostrich, turkey and other poultry animals, as well as for ancillary or allied businesses, such as feed mill, dressing plant, and hatchery. Under the Program, up to 80% of the total project cost may be borrowed with an interest rate based on the prevailing market rate, depending on the term of the loan and credit rating of the borrowers. Short term loans are payable up to one year, while term loans are payable based on project cash flow or payback period but not more than the economic useful life of fixed assets. Since April 2015, LANDBANK has approved loans totaling P26.9 billion under the Poultry Lending Program, with outstanding loans amounting to P12.5 billion supporting 400 borrowers as of end-June 2022. The next run of the LANDBANK AgriSenso Virtual Forum will be held on 30 August 2022 to discuss opportunities for growth for the livestock industry. Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate to promote inclusive and sustainable development. On 8 August 2022, the Bank celebrated its 59th anniversary, representing almost six decades of service to the nation.

LEARN MORE

LANDBANK lends P5.8-B to boost climate resiliency of agri sector

In support of building a climate-resilient agri-business value chain in the country, the Land Bank of the Philippines (LANDBANK) has approved loans totaling P5.8 billion to 15 borrowers as of 30 June 2022. Through the LANDBANK Climate Resilient Agriculture Financing Program, the Bank aims to finance farming technologies, systems, facilities and equipment that will help local farms and fisheries become more adaptive and resilient to the effects of climate change, such as severe storms and prolonged drought. “LANDBANK supports investments in innovative technologies that will help address climate change risks in the agriculture sector. This modernization is aimed towards improving the production and income of our local farmers while ensuring national food security amid the changing global climate,” said LANDBANK President and CEO Cecilia C. Borromeo. The Program can finance crop, livestock, and fishery projects that utilize climate-resilient technologies, such as the adoption of planting materials and seedling techniques for climate-resistant food crops, pipe irrigation that helps prevent water loss during dry season, and climate-adaptive farming systems such as terracing. Modern facilities and equipment that minimize harvest and post-harvest losses during typhoons can also be financed under the Program, including rice harvesters, dryers and outdoor grain storage facilities. The Program can also provide credit fund for working capital and the construction of facilities such as greenhouses, reservoirs, rainwater collecting systems, and farm-to-market roads with drainage, and other new and emerging technologies approved and endorsed by the Department of Agriculture (DA) and the concerned Municipal Agricultural Office. Under the LANDBANK Climate Resilient Agriculture Financing Program, cooperatives, associations, and private borrowers categorized as single proprietorships, partnerships, or corporations may borrow up to 80% of the total project cost. Meanwhile, local government units (LGUs) may borrow not more than their net borrowing capacity as certified by the Bureau of Local Government Finance (BLGF). Term loans for working capital and permanent working capital are payable up to one (1) year and three (3) years, respectively, while loans for fixed assets and construction of facilities are payable based on cash flow but not more than its economic useful life. The interest rate shall be based on the prevailing market rate. The LANDBANK Climate Resilient Agriculture Financing Program underscores the Bank’s commitment towards advancing a more resilient agriculture sector while promoting environmental sustainability. Meanwhile, in his recent State of the Nation Address (SONA), President Ferdinand Marcos, Jr. identified climate change and its impact on agriculture as one of the top priorities of his administration. Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate to promote inclusive and sustainable development. On 8 August 2022, the state-run Bank celebrated its 59th anniversary, representing almost six decades of service to the nation.

LEARN MORE

LANDBANK digital transactions jump 25% in H1 2022

For the first half of 2022, the major digital banking channels of the Land Bank of the Philippines (LANDBANK) registered growths of 25% in volume and 21% in value, year-on-year, facilitating a total of 77.6 million transactions valued at P1.4 trillion. The increases represent combined transactions from the LANDBANK Mobile Banking App (MBA), iAccess, weAccess, Link.BizPortal, Electronic Modified Disbursement System (eMDS), and the LANDBANK Bulk Crediting System (LBCS). “LANDBANK remains committed to promoting greater digital adoption in support of the National Government’s financial inclusion agenda. Our safe, convenient and accessible digital banking products are designed to meet the needs of our diverse customer base, as we continue serving the nation,” said LANDBANK President and CEO Cecilia C. Borromeo. The LANDBANK MBA led in terms of transaction volume with 59.8 million amounting to P103.1 billion, translating to 27% and 37% increases in volume and value, respectively. In terms of value, the Bank’s internet facility for national government partners, eMDS, topped the list with a total value of P966.2 billion or a 22% rise year-on-year, from facilitating 1.2 million transactions. The LANDBANK weAccess—the Bank’s corporate internet banking platform—also recorded growths of 17% in transactions and 11% in value, facilitating more than 10 million transactions worth P262.8 billion. Meanwhile, LANDBANK’s web-based payment channel, Link.BizPortal, facilitated 2.8 million transactions equivalent to a 48% increase, with a corresponding total value of P6 billion or 30% growth rate. Lastly, the LANDBANK iAccess and LBCS—the Bank’s online retail banking channel and electronic disbursement facility, repectively—recorded a combined total volume of 2.8 million transactions amounting to P15.3 billion. With the soaring demand for digital banking channels amid the pandemic, LANDBANK assures customers that it is maintaining the highest level of security in all its systems, as it also reminds customers to remain vigilant against online banking fraud and scams. Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate to promote inclusive and sustainable development. On 8 August 2022, the Bank celebrated its 59th anniversary, representing almost six decades of service to the nation.

LEARN MORE

LANDBANK deploys Mobile ATM in quake-hit Abra

BANGUED, Abra – The Land Bank of the Philippines (LANDBANK) quickly deployed a mobile automated teller machine (ATM) to the Municipality of Bangued, Abra starting 29 July 2022, to service the cash requirements of customers in the province in the aftermath of the recent 7.0-magnitude earthquake that badly hit parts of Northern Luzon. Stationed at the LANDBANK Bangued Branch, the LANDBANK Mobile ATM provided basic banking services to calamity-affected residents, such as cash withdrawals, balance inquiries, bills payments, and fund transfers, until 3 August 2022. The LANDBANK Mobile ATMs are designed to be deployed in areas with disrupted or limited access to banking services due to disasters or calamities. In line with its 59th Anniversary celebration on 8 August 2022, LANDBANK recently launched 10 new Mobile ATMs on 5 August 2022, increasing the total number of units to 20 nationwide.

LEARN MORE

LANDBANK agri loans hit P257.7-B as of end-June

Celebrating 59 years of serving the nation As Land Bank of the Philippines (LANDBANK) celebrates its 59th anniversary on 8 August 2022, the state-run Bank remains committed to servicing the development requirements of small farmers, fishers, and other key players in the agri-business value chain, as loans to the agriculture sector reached P257.7 billion as of 30 June 2022. The P257.7 billion total outstanding loans translate to a 15.5% increase from the same period a year ago, further solidifying LANDBANK’s position as the biggest lender to the agriculture sector in the country. “LANDBANK stands ready to extend accessible credit to all agri players to boost the country’s food production and supply. We will continue ramping up our lending activities in full support of the new administration’s agricultural modernization agenda,” said LANDBANK President and CEO Cecilia C. Borromeo. Of the P257.7 billion total outstanding loans, P37.5 billion benefited small farmers and fishers, including those which were channeled through cooperatives and farmers’ associations, rural financial institutions, and other conduits. A total of P163.1 billion supported small, medium, and large agribusiness enterprises, while the remaining P57 billion aided agri-aqua related projects of local government units (LGUs) and government-owned and controlled corporations (GOCCs). The loans were used to finance various economic activities, including P56.7 billion for livestock, crops and fisheries production, and P122.2 billion for agri-processing and trading of rice, corn, and sugarcane, among others. A total of P78.8 billion also backed the construction and improvement of essential agriculture infrastructure such as public markets, farm-to-market roads, warehouses, cold storages, irrigation systems, and slaughterhouses. In the first six months of 2022, LANDBANK also assisted in the construction and improvement of 138 kilometers of farm-to-market roads—which is one of the priorities in President Ferdinand Marcos, Jr.’s development plan for the agriculture sector. Agri-Mechanization Financing Program In support of the President’s long-term goal to modernize agricultural production, LANDBANK has been offering the Agri-Mechanization Financing Program designed to promote mechanization of production and post-production processes, from planting to harvesting and processing, thereby increasing efficiency, reducing post-harvest losses and lowering production costs. The LANDBANK Agri-Mechanization Financing Program has supported 53 micro and small enterprises and cooperatives with cumulative loan releases totaling P681.5 million as of end-June 2022. More Small Farmers and Fishers Assisted By adopting a more focused and direct lending approach, LANDBANK has cumulatively assisted more than 3.3 million farmers and fishers nationwide, of which 566,462 or 17% came from the 20 poorest provinces in the country. The top provinces with the highest number of beneficiaries include Nueva Ecija, Maguindanao, Bohol, Pangasinan, Cotabato, Isabela, Cagayan, Leyte, Ilocos Sur, and South Cotabato. LANDBANK’s close collaboration with the Department of Agriculture (DA) and the Department of Agrarian Reform (DAR) has also allowed it to reach and serve more farmers and fishers. As of 30 June 2022, LANDBANK has extended a total of P13.3 billion to 247,591 borrowers under the programs it is administering for DA, and another P719.4 million to more than 200 agrarian reform beneficiary (ARB) organizations benefiting over 11,000 ARBs and small farm holders under DAR’s programs. Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate to promote inclusive and sustainable development, representing almost six decades of service to the nation.

LEARN MORE

LANDBANK launches 10 mobile ATMs to bring services closer to customers

The Land Bank of the Philippines (LANDBANK) kicked off its 59th anniversary month celebration with the official inauguration of 10 mobile automated teller machines (ATMs) today, 05 August 2022, designed to service communities with disrupted or limited access to banking services. LANDBANK President and CEO Cecilia C. Borromeo, together with Manila Mayor Maria Sheilah “Honey” Lacuna-Pangan and Vice Mayor John Marvin “Yul” C. Nieto, led the blessing and inauguration of the LANDBANK Mobile ATMs at the Plaza Rajah Sulayman in Malate, Manila. They were joined by LANDBANK Director Virgilio DV. Robes, LBP Leasing and Finance Corporation (LLFC) President and CEO Michael P. Arañas, LANDBANK Executive Vice Presidents Alex A. Lorayes, Alan V. Bornas and Carel D. Halog, Senior Vice President Randolph L. Montesa, and other LANDBANK senior officials. “The launch of new LANDBANK Mobile ATMs today reflects our continuing commitment to deliver unhampered and essential services to customers. We are also expanding our reach nationwide to promote greater financial inclusion, as part of our broader thrust to spur inclusive and sustainable development,” said LANDBANK President and CEO Borromeo. Six (6) of the new LANDBANK Mobile ATMs will be stationed in LANDBANK branches located in Luzon—including two units in Metro Manila—and two units each in Visayas and Mindanao. The new touchpoints increase LANDBANK’s total mobile ATMs to 20 and a wider ATM network of 2,877. Designed as an offsite ATM mounted on a customized transport vehicle, the LANDBANK Mobile ATM can provide basic banking services, such as cash withdrawal, balance inquiry, bills payment, and fund transfer. The LANDBANK Mobile ATMs can be deployed in areas affected by disasters or calamities, including cash payouts to beneficiaries of the National Government’s Conditional and Unconditional Cash Transfer (CCT/UCT) Programs under the Department of Social Welfare and Development (DSWD). Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate of promoting national development. On 8 August 2022, the state-run Bank will mark its 59th anniversary, representing almost six decades of service to the nation.

LEARN MORE

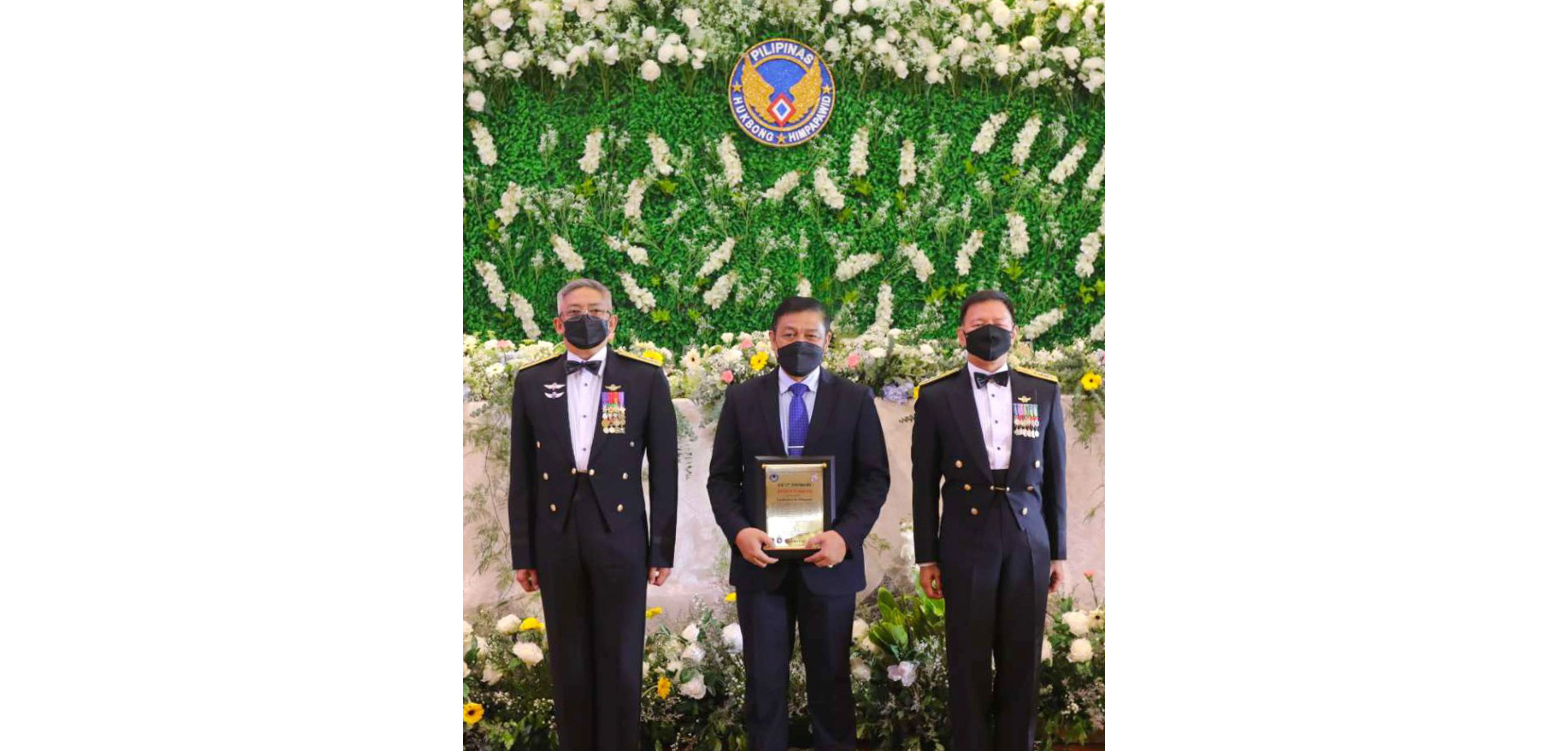

Air Force salutes LANDBANK as outstanding ‘wingman’

LANDBANK South NCR Branches Group Head, Senior Vice President Ramon R. Monteloyola (center) receives the plaque of recognition on behalf of LANBANK from PAF Commanding General Lt. Gen. Connor Anthony D. Canlas, Sr. (left) and AFP Vice Chief of Staff Lt. Gen. Erickson R. Gloria (right) during the PAF 75th Anniversary Night celebration. The Land Bank of the Philippines (LANDBANK) was conferred with the Outstanding Stakeholder honor for the second year in a row by the Philippine Air Force (PAF) during its 75th Anniversary Night celebration at the Sheraton Hotel in Pasay City. The PAF recognized LANDBANK’s invaluable and continuous support over the years, notably the Bank’s digital banking facilities that the Air Force is utilizing. LANDBANK was instrumental in creating the one-time crediting system with the Air Force Accounting Office for PAF personnel’s salary and allowances; and the PAF Online Payment System which allows personnel to settle government-related accountabilities and dues through LANDBANK’s digital payment portal. “LANDBANK is one with the Philippine Air Force in its ongoing defense modernization efforts, as we continue to serve the country’s armed forces with convenient and accessible digital banking services,” said LANDBANK President and CEO Cecilia C. Borromeo. LANDBANK South NCR Branches Group Head, Senior Vice President Ramon R. Monteloyola received the plaque of recognition on behalf of the Bank from Armed Forces of the Philippines (AFP) Vice Chief of Staff Lt. Gen. Erickson R. Gloria and PAF Commanding General Lt. Gen. Connor Anthony D. Canlas, Sr. To sufficiently serve PAF personnel especially during peak demand, LANDBANK recently installed an offsite ATM in Clark Air Base and deployed a mobile ATM at the Air Education Training and Doctrine Command at Fernando Air Base in Lipa City, Batangas. The state-run Bank also previously facilitated the processing and distribution of LANDBANK ATM cards to all PAF trainees. LANDBANK is leveraging on the latest technology to support the digitalization of various government operations as part of its expanded mandate of serving the nation.

LEARN MORE

LANDBANK income surges 94% to P20.3-B in H1 2022

The Land Bank of the Philippines (LANDBANK) recorded a net income growth of 93.5% to P20.3 billion in the first half of 2022 from P10.3 billion a year ago, alongside doubledigit increases in assets and deposits. LANDBANK’s substantial expansion in net income is attributed to its prudent management of the cost of funds as well as sustained interest income from loans and investments. “LANDBANK’s robust financial performance will continue to drive its intensified assistance to key industries, especially the agriculture sector, in support of the country’s continuing recovery. We will also build on this growth momentum to further our efforts to rebuild local communities, advance financial inclusion, and support the National Government’s development agenda,” said LANDBANK President and CEO Cecilia C. Borromeo. LANDBANK’s total assets in the first half of the year grew by 11.8% to P2.8 trillion, further solidifying its ranking as the second-largest bank in the country. This was propelled by deposits amounting to P2.5 trillion, up 10.1% year-on-year. The government sector continues to account for the bulk of LANDBANK’s total deposits at 62% or P1.5 trillion, while the private sector comprised the remaining 38% share amounting to P930 billion. LANDBANK posted modest capital growth year-on-year at 1.9% to P206.5 billion, primarily due to the 93.5% surge in net income for the six-month period ended 30 June 2022. The Bank’s financial ratios remain at healthy levels, with return on equity at 15.43%, return on assets at 1.19%, and net interest margin at 2.92%. Through the years, LANDBANK has grown into one of the leading universal banks in the country, while remaining faithful to its social mandate to promote inclusive and sustainable development. On 8 August 2022, the state-run Bank will mark its 59th anniversary, representing almost six decades of service to the nation.

LEARN MORE

LANDBANK assistance injects hope to Davao de Oro banana plantation

LANDBANK’s timely assistance helped Reicher Banana Farm, Inc. (RBFI) in Davao de Oro to register a 100% growth in production and fully recover from the dreaded Panama disease. PANTUKAN, Davao de Oro – When Reichard Dumaluan’s 74-hectare banana plantation was hit hard by the destructive Panama plant disease in 2013, his business was at serious risk of wilting away along with the infected trees in his farm. The Panama disease infested Cavendish plantations throughout the province (formerly Compostela Valley) and neighboring towns in the region, only four years after Dumaluan established the plantation, Reicher Banana Farm, Inc. (RBFI), in 2009. Over time, the disease caught on, affecting the quality and quantity of RBFI’s produce. With plantation yield and income significantly reduced, RBFI sought financial assistance from the Land Bank of the Philippines (LANDBANK) to rehabilitate and sustain their operations. RBFI availed of a P75-million loan from LANDBANK in 2018 to supplement working capital and purchase the necessary inputs and equipment for rehabilitation. After two years of rehabilitation, RBFI fully recovered from the plant disease and is now harvesting around 10,000 boxes of produce a week—a 100% increase from the previous production of 5,000 boxes a week. “LANDBANK recognizes the importance of each subsector of agriculture to ensure food security. Through accessible credit assistance, we stand ready to support the diverse requirements of agri players to boost production and income,” said LANDBANK President and CEO Cecila C. Borromeo. RBFI also used a portion of the LANDBANK loan for land expansion and modernization, which includes the purchase of a digital device which can record data per banana bunch, such as its weight, age, and location in the plantation. With the data, RBFI can digitally monitor the health of the crops and accurately distributes farm inputs such as fertilizers, thereby helping the company save on costs. The generated data also allows RBFI to forecast harvests within a given season. “I am grateful for LANDBANK’s support, especially at a time we needed it the most. As a client, we appreciate the customer service, as well as the financial and technical support they provide for our production,” Reichard Dumaluan said. RBFI has since expanded its plantation to 130 hectares and generates employment for around 220 local residents. Their banana harvest is also being exported to different countries, including South Korea, China, and the Middle East, among others. As of 30 June 2022, LANDBANK’s loan portfolio to support the country’s banana industry has reached P1.49 billion, in line with its intensified service to the agriculture sector.

LEARN MORE

LANDBANK launches ’PISO’ account for unbanked Filipinos

Students, public utility vehicle drivers, vendors, household helpers, farmers, fishers, and other unbanked and underserved Filipinos can now open a LANDBANK PISO account with just P1.00 as minimum initial deposit. The Land Bank of the Philippines (LANDBANK) offers a new product to help bring more unbanked and underserved Filipinos—including students, public utility vehicle drivers, vendors, household helpers, farmers, and fishers—into the country’s formal banking system. Through the LANDBANK “Perang Inimpok Savings Option” or PISO account, interested customers can open a LANDBANK deposit account with only P1.00 as minimum initial deposit and up to a maximum of P50,000 account balance. The depositor is only required to submit one (1) valid identification card or any Barangay certification, clearance, or ID for verification. The LANDBANK PISO account is being offered to individuals without an existing LANDBANK deposit account and have no capacity to open a regular deposit savings account with higher initial deposit and maintaining balance requirements. “The LANDBANK PISO is another testament of our commitment to advance the National Government’s financial inclusion agenda. We continue to develop accessible and convenient banking products relevant to the diverse needs of our customers, including the unbanked and underserved,” said LANDBANK President and CEO Cecilia C. Borromeo. With the LANDBANK PISO, accountholders can access the Bank’s array of digital banking channels such as the iAccess, Link.BizPortal, and the Mobile Banking App for fund transfer, bills payment, and balance inquiry services. Accountholders can also use the PISO account in any LANDBANK, BancNet, and 7-Eleven Automated Teller Machines (ATMs), domestic Point-of-Sale (POS) terminals, and for over-the-counter transactions in their respective LANDBANK branch of account. Interested individuals may go to the nearest LANDBANK Branch in their area to open a LANDBANK PISO account. LANDBANK remains to be the only bank present in all of the country’s 81 provinces. As of 30 June 2022, the state-run Bank operates 608 branches; 2,847 ATMs; and 233 Cash Deposit Machines nationwide.

LEARN MORE